Vove ID Digital KYC Verification Process

The Vove ID digital KYC (Know Your Customer) verification process is a comprehensive approach designed to authenticate and verify customer identities. Below is a detailed explanation of each step involved in the process:

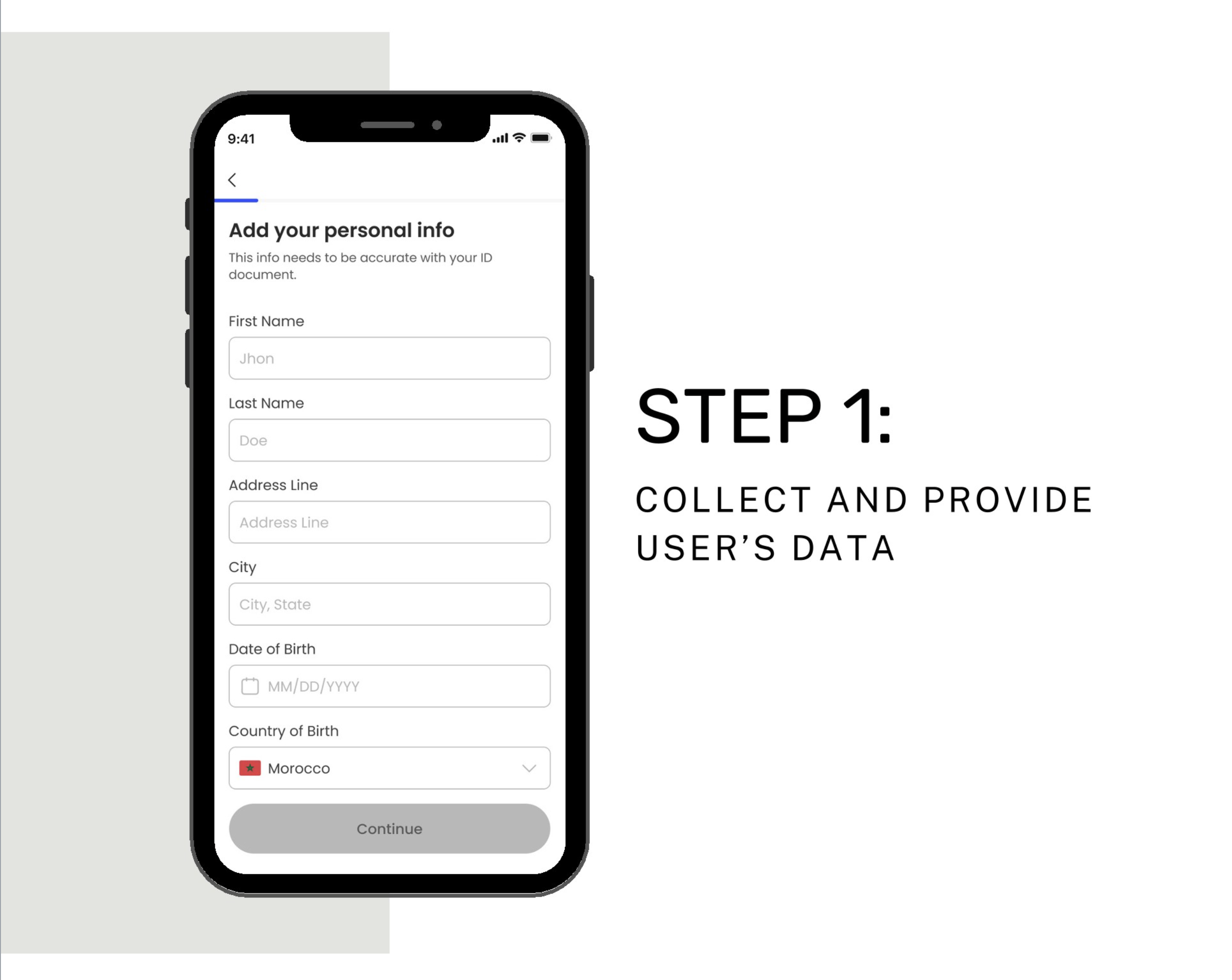

Step 1: Collection of Personal Information

In the initial stage of the KYC process, customers are prompted to submit their personal identifiable information (PII) as a part of the account registration procedure. This information encompasses various critical data points, including:

- Full Name

- Date of Birth

- Address, city

- Country of birth

- Identity Document Details

This comprehensive data collection is essential to ensure accurate identity verification and compliance with regulatory standards.

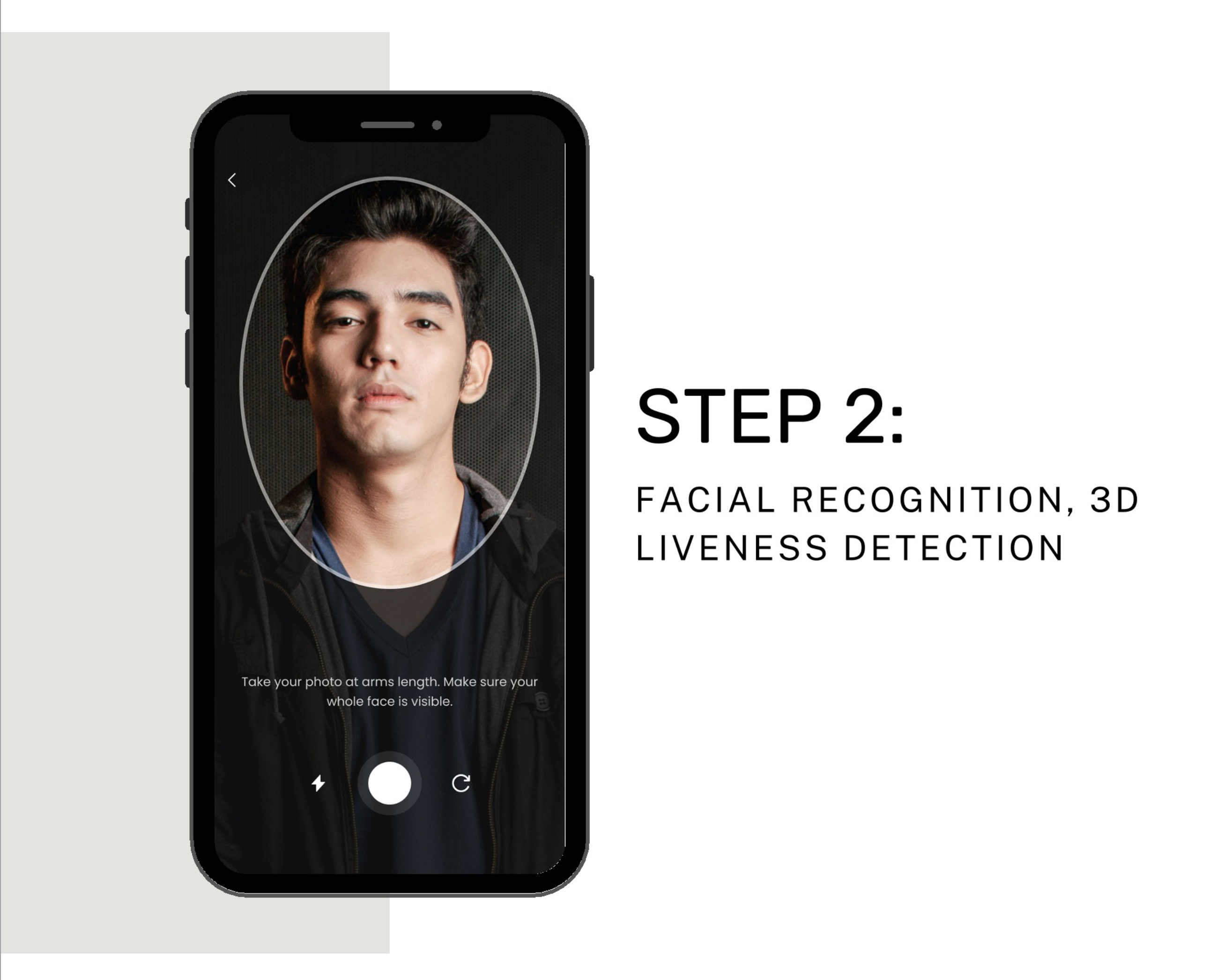

Step 2: Facial Recognition and 3D Liveness Detection

The second phase of the KYC process employs sophisticated biometric technology, incorporating facial recognition and 3D liveness detection techniques. This stage is pivotal in authenticating that the individual being analyzed is physically present and not a fraudulent representation. The system effectively counters potential spoofing attempts involving photographs, 3D masks, or any other artificial renditions. By creating and analyzing three-dimensional maps of the user's face, this method establishes a highly secure and reliable form of user authentication, significantly enhancing the integrity of the identity verification process.

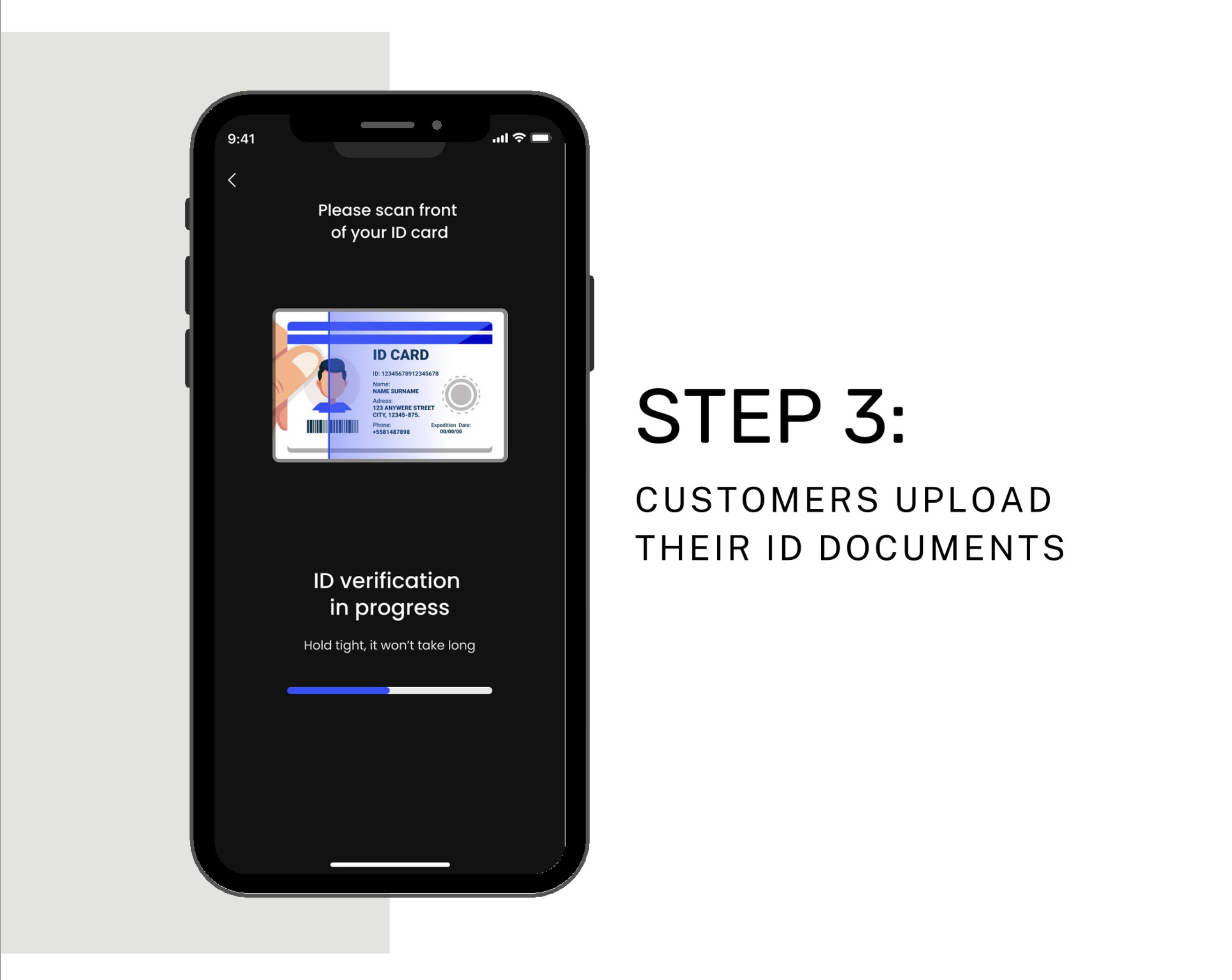

Step 3: Identity Document Submission

Following the initial data submission, the next step involves customers uploading scanned copies or clear photographs of their identity documents. Our platform, Vove ID, accommodates an extensive array of over 1,400 types of ID documents from more than 190 countries and territories, and is capable of supporting over 50 languages. We utilize state-of-the-art optical character recognition (OCR) technology to efficiently extract necessary information from these uploaded documents. This data is then processed further, ensuring thorough and accurate verification of the customer's identity.

Step 4: Final Verification and Results

In the final stage of the KYC process, the collected data from the previous steps undergoes a comprehensive cross-referencing check. This is done against both in-house and external databases, including sanctions lists and politically exposed person (PEP) screening records. The aim is to ensure thorough compliance and risk assessment.

Once this verification is complete, the final results are compiled and delivered. For our clients, a complete proof of the verification process is meticulously documented and made accessible in their back office system. If the customer successfully clears all the verification stages, this marks the successful completion of their onboarding process, confirming their identity and ensuring regulatory compliance.

Indeed, the Know Your Customer (KYC) verification process can vary significantly depending on both the industry in which your organization operates and the specific geographic location. This variation is largely due to the differing KYC compliance regulations that exist in different jurisdictions and sectors. Understanding and adapting to these variations is crucial for conducting effective and compliant KYC procedures, particularly when incorporating video interview techniques.