Cross-Border Payments: 5 Must-Have KYC Tools in 2025

Discover 5 leading KYC solutions for cross-border payment companies in 2025. Learn how fintechs can strengthen compliance, reduce fraud, and scale globally with digital identity verification.

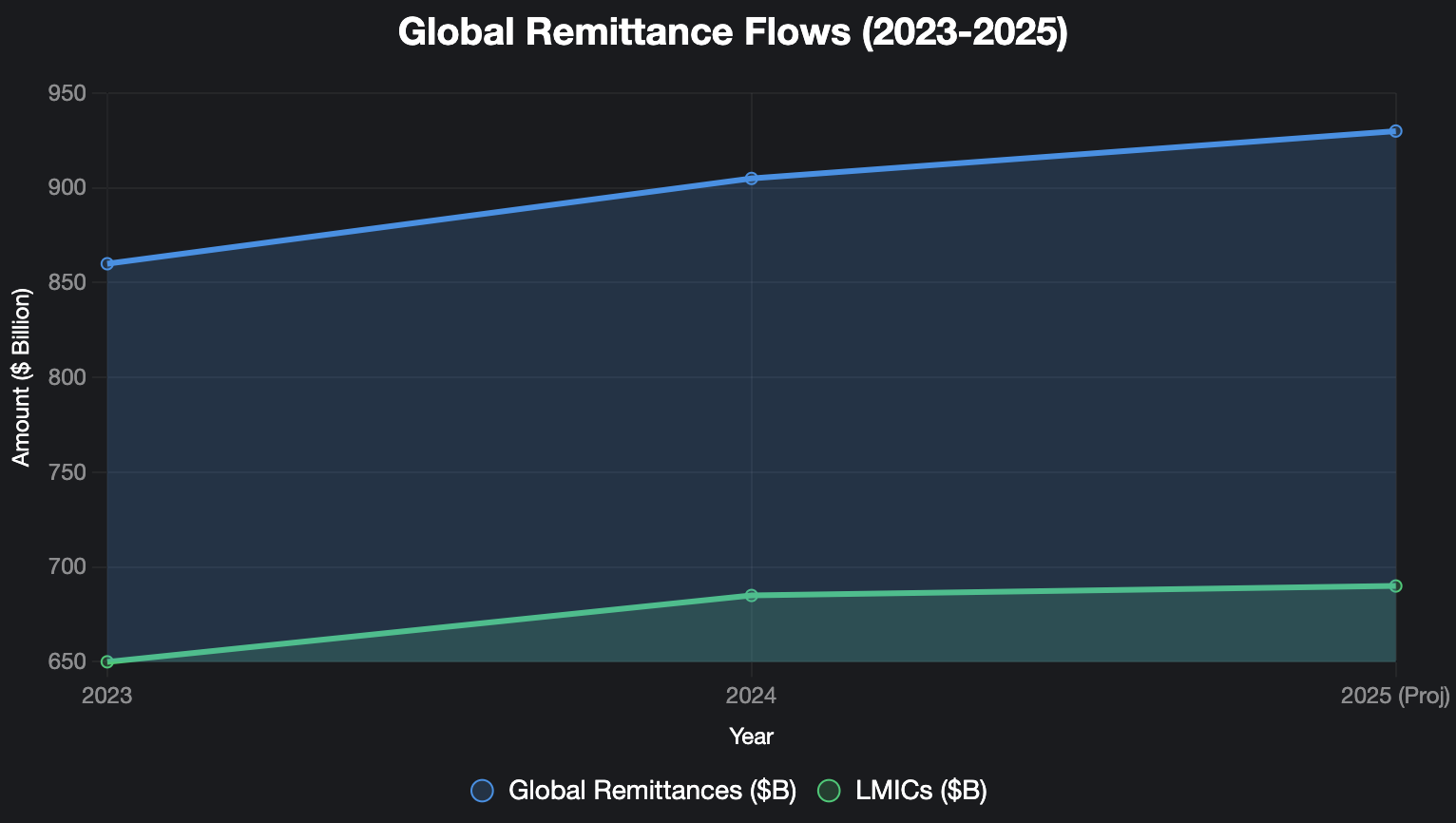

Cross-border payment companies are the backbone of today’s digital economy, moving money across borders for millions of individuals and businesses. In Africa, the Middle East, and beyond, remittances remain a lifeline, fueling household income and trade. Globally, the market continues to expand: in 2024, remittance flows reached $905 billion, a 4.6% increase over 2023 (World Bank). For 2025, projections suggest steady growth, with remittances to low- and middle-income countries expected to reach about $690 billion (World Bank, Federal Reserve).

This growth comes with increased scrutiny. Regulators, from the Financial Action Task Force (FATF) to local central banks, demand stronger safeguards against money laundering, terrorist financing, and identity fraud. For cross-border payment providers, Know Your Customer (KYC) compliance is no longer just a requirement, but a strategic necessity for gaining trust, accessing banking partnerships, and scaling globally.

In 2025, fintechs must adopt smarter KYC tools that balance compliance, customer experience, and operational efficiency. Below are five essential KYC solutions designed for cross-border payment companies.

1. Automated Identity Verification

Manual onboarding is too slow and error-prone for fast-moving cross-border payment firms. Automated identity verification brings speed, accuracy, and scalability.

Key features include:

- Biometric authentication: facial recognition, fingerprint scans, and liveness detection confirm the customer is genuine.

- Document verification: AI-driven Optical Character Recognition (OCR) validates passports, IDs, and residence permits.

- Fraud detection: algorithms detect tampered documents, deepfakes, or synthetic identities.

A payments startup operating between Nigeria and Kenya implemented an automated verification API. Within one month, onboarding times dropped from 48 hours to under 5 minutes, while manual review costs fell by 70%. Fraud-related rejections also decreased by 15%.

2. Global Watchlist & Sanctions Screening

Cross-border transfers carry elevated risks of money laundering and terrorism financing. Global regulators require strict customer screening against international and domestic sanctions.

A robust screening solution includes:

- Sanctions checks: real-time monitoring of OFAC, UN, EU, UK HMT, and national lists.

- Politically Exposed Persons (PEPs): identifying high-risk profiles, such as government officials or close associates.

- Adverse media monitoring: scanning global news for links to fraud, corruption, or financial crime.

Failing to comply can result in multimillion-dollar fines and reputational damage. For example, in recent years, several global banks were penalized for inadequate sanctions screening. Payment startups are not exempt: regulators expect the same vigilance.

3. Multi-Language & Multi-Document Support

Cross-border payment companies often operate in diverse markets, where customers present a wide range of IDs in multiple languages. A solution must adapt to this complexity.

Capabilities to look for:

- Support for diverse ID types: passports, national ID cards, biometric voter IDs, residence permits, even mobile money statements.

- Language coverage: Arabic, French, Swahili, and other regional scripts.

- Local compliance alignment: e.g. Ghana’s voter ID, Nigeria’s National Identity Number (NIN), Kenya’s Huduma Namba, or Jordan’s smart ID.

This adaptability reduces customer friction and ensures compliance across jurisdictions. Without it, payment companies risk excluding legitimate customers or facing onboarding delays.

4. Continuous KYC (Ongoing Monitoring)

In 2025, regulators are shifting from one-time verification to ongoing due diligence. FATF’s June 2025 Recommendations reinforce the importance of continuous monitoring for higher-risk sectors, including cross-border payments.

Continuous KYC enables companies to:

- Track risk changes: flagging when customers are newly sanctioned, become PEPs, or show adverse media signals.

- Monitor transaction patterns: identifying unusual remittance flows, large transfers inconsistent with profiles, or rapid transfers through high-risk corridors.

- Generate alerts and reports: facilitating compliance with Suspicious Activity Report (SAR) requirements.

In 2024, an African payment platform detected abnormal transaction spikes from a previously low-volume customer. Continuous KYC flagged the account, cross-checking it with an updated regional sanctions list. Within hours, the company froze transactions, preventing an illicit outflow of over $500,000 and avoiding regulatory penalties.

This demonstrates how proactive monitoring directly protects both compliance standing and financial integrity.

5. Seamless API Integration for Fintechs

Modern fintechs cannot afford clunky compliance tools. KYC solutions must integrate directly into apps and platforms through lightweight APIs and SDKs.

Benefits of API-first KYC solutions:

- Frictionless user experience: verification happens within the payment flow, avoiding customer drop-offs.

- Scalability: easily handles spikes in users during launches or cross-border expansions.

- Customizable workflows: risk-based verification tailored to geography, transaction value, or customer profile.

This flexibility allows startups to remain compliant without sacrificing growth or UX — a critical differentiator in competitive markets.

Regulatory Spotlight: What’s New in 2025

- FATF Updates (June 2025): FATF refined its Recommendations and interpretative notes, emphasizing proportional, risk-based AML/CFT measures.

- Financial Inclusion & AML: New FATF guidance (2025) highlights balancing compliance with financial access in underserved regions.

- Crypto & KYC in 2025: Under the EU’s Markets in Crypto-Assets Regulation (MiCA), crypto platforms must now apply KYC to all users, including P2P and crypto-to-fiat transactions. In MENA, Gulf regulators are mandating real-time monitoring for exchanges, while African regulators are aligning crypto wallets with traditional AML obligations. For cross-border payment companies handling crypto remittances, this means full-scale identity checks, sanctions screening, and reporting requirements are no longer optional, they’re mandatory.

- EU AML Regulation: The EU’s newest AML Directive strengthens enforcement for payment institutions, with ripple effects on providers globally.

These changes mean cross-border payment companies must choose KYC partners who are forward-looking and able to adapt quickly to evolving compliance demands.

Why the Right KYC Partner Matters

Not all KYC providers are equipped to handle the complexity of cross-border payments. Providers should deliver:

- Global coverage with local compliance expertise

- AI-driven fraud detection and automation

- Real-time sanctions and PEP monitoring

- API-ready solutions for rapid deployment

This is where VOVE ID delivers. With multilingual document support, sanctions screening, and AI-powered onboarding, VOVE ID helps high-growth fintechs in Africa and MENA stay compliant while scaling across borders. Its seamless APIs make integration simple, ensuring compliance doesn’t slow growth.

Conclusion

The cross-border payments industry is one of the most heavily regulated sectors in finance. With global remittances approaching $905 billion in 2024 and projected to keep growing in 2025 (Federal Reserve), regulators are intensifying scrutiny.

For payment companies, compliance is not just about avoiding fines, but building trust, unlocking banking partnerships, and securing international expansion.

By adopting the five KYC solutions outlined above (automated identity verification, sanctions screening, multi-language document support, continuous monitoring, and seamless API integration) cross-border payment providers can strengthen compliance while offering customers the fast, secure, and user-friendly experience they expect.

Cross-border payments represent nearly 25% of total transaction volumes in Sub-Saharan Africa, making the region one of the most regulated corridors globally.

FATF estimates that money laundering accounts for 2–5% of global GDP annually — equivalent to trillions of dollars.

In some African markets, over 50% of remittances are processed through mobile money, highlighting the importance of mobile-first KYC solutions.

Compliance shouldn’t slow you down. With VOVE ID’s AI-powered KYC, you can onboard customers faster, stay audit-ready, and scale globally with confidence.