AML Compliance in Egypt: A 2025 Guide for Fintechs and Regulated Businesses

Stay compliant with Egypt’s AML regulations in 2025. Explore key updates to Law 80/2002, FATF guidance, CBE and FRA rules, eKYC, GoAML, and digital identity verification for fintechs and regulated businesses.

Egypt’s AML Law: Foundation and 2023 Reforms

Egypt’s primary AML legislation, Law No. 80 of 2002, criminalizes money laundering, requires reporting of suspicious transactions, and establishes mechanisms for asset freezing. The law is enforced by the Egyptian Money Laundering and Terrorist Financing Combating Unit (EMLCU), the country’s Financial Intelligence Unit (FIU).

In January 2023, Prime Ministerial Decree No. 3331 updated the executive regulations to align with Financial Action Task Force (FATF) standards. Key changes include:

- Expansion of reporting entities to include fintech startups and virtual asset service providers.

- Clearer guidance on risk-based customer due diligence (CDD).

- Enhanced requirements for identifying ownership structures.

- Stronger penalties for non-compliance.

These updates reflect Egypt’s commitment to global AML/CFT standards while fostering foreign direct investment in digital finance.

Key Regulatory Bodies: CBE, FRA, and EMLCU

Central Bank of Egypt (CBE)

The Banking Law No. 194 of 2020 empowers the CBE to regulate AML/CFT for banks, digital wallets, and fintechs. The CBE mandates:

- Full Know Your Customer (KYC) checks for account opening.

- Integration with the GoAML platform for suspicious transaction reporting.

- Development of internal risk assessment frameworks.

In January 2025, the CBE published a manual for identifying ownership structures, outlining a risk-based approach critical for Know Your Business (KYB) procedures, especially for payment processors and startups working with SMEs.

Financial Regulatory Authority (FRA)

The FRA oversees AML for non-banking financial institutions (NBFIs), such as leasing companies and securities firms. In October 2024, Decree No. 161 required NBFIs to implement:

- Digital identity verification.

- Continuous customer due diligence.

- Timely suspicious activity reporting via GoAML.

Egyptian Money Laundering and Terrorist Financing Combating Unit (EMLCU)

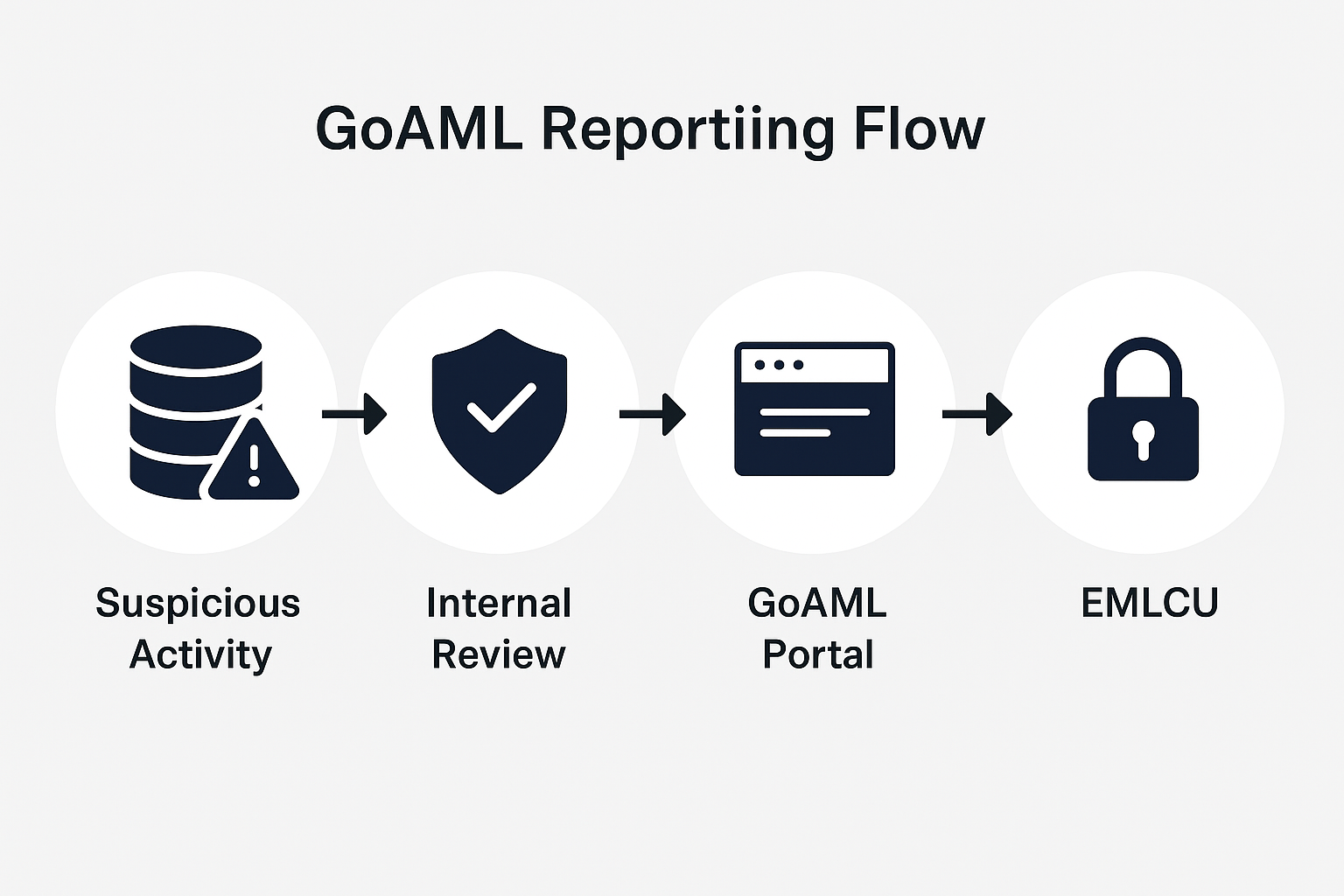

As Egypt’s FIU, the EMLCU analyzes and disseminates suspicious transaction reports (STRs) through the GoAML platform, developed by the UNODC.

FATF Evaluation: Where Egypt Stands

Egypt, a member of the Middle East and North Africa FATF (MENAFATF) since 2004, made progress in its May 2024 FATF follow-up report after the 2021 mutual evaluation.

Strengths:

- Improved rating for Recommendation 10 (CDD) due to digital onboarding regulations.

- Better alignment on internal controls and reporting.

Weaknesses:

- Partial compliance with Recommendation 3 (money laundering criminalization), Recommendation 24 (ownership transparency), and Recommendation 28 (DNFBP oversight).

- Lack of a centralized ownership registry.

📚 Curious how Egypt compares? Check our 2025 AML Compliance Guide for Nigeria.

The Role of Technology: eKYC and GoAML

Egypt’s financial sector is embracing digital tools for AML enforcement. The GoAML platform, implemented by EMLCU since 2022, standardizes STR reporting with XML integration and digital signatures. All regulated entities must use GoAML.

The CBE supports eKYC technologies, including:

- Facial recognition with 3D liveness detection.

- Document verification via optical character recognition (OCR).

- API-based integrations.

These tools enable real-time onboarding, especially for mobile wallets and neobanks in rural areas.

💡 For fintechs seeking compliant identity verification in Egypt, VOVE ID offers AI-powered tools for eKYC (including 3D liveness detection and verification of 2000+ document types), KYB, ownership structure verification, and real-time watchlist screening for sanctions and PEPs—aligned with Egypt’s AML regulations and FATF standards. It’s a scalable solution for startups expanding across MENA.

AML Challenges in Egypt

Egypt faces structural hurdles:

- High Cash Usage: Informal markets complicate transaction monitoring.

- Fragmented Ownership Oversight: No centralized registry for ownership structures.

- Low Digital Literacy: Smaller firms struggle with eKYC and GoAML adoption.

- DNFBP Gaps: Weak oversight of law firms and real estate increases risks.

CTA: Need Help With AML Compliance in Egypt?

Whether you’re a fintech, neobank, or regulated entity, staying AML-compliant is critical.

✨ VOVE ID helps businesses:

- Automate KYC and KYB checks.

- Comply with CBE and FRA digital onboarding rules.

- Streamline AML compliance processes.

- Verify ownership structures and monitor for sanctions and PEPs.

👉 Contact VOVE ID to support your AML and digital identity strategy in Egypt and beyond.

Final Thoughts

Egypt’s AML framework is aligning with FATF standards while fostering digital innovation. For fintechs, robust AML programs combining local compliance and global best practices are a competitive edge in a market driven by trust and regulatory clarity.