KYB Compliance in Uganda: 2025 Guide for Regulated Businesses

Discover how Uganda’s evolving regulatory framework is shaping KYB (Know Your Business) compliance in 2025. Learn how fintechs and financial institutions can strengthen business verification, AML compliance, and digital onboarding with VOVE ID.

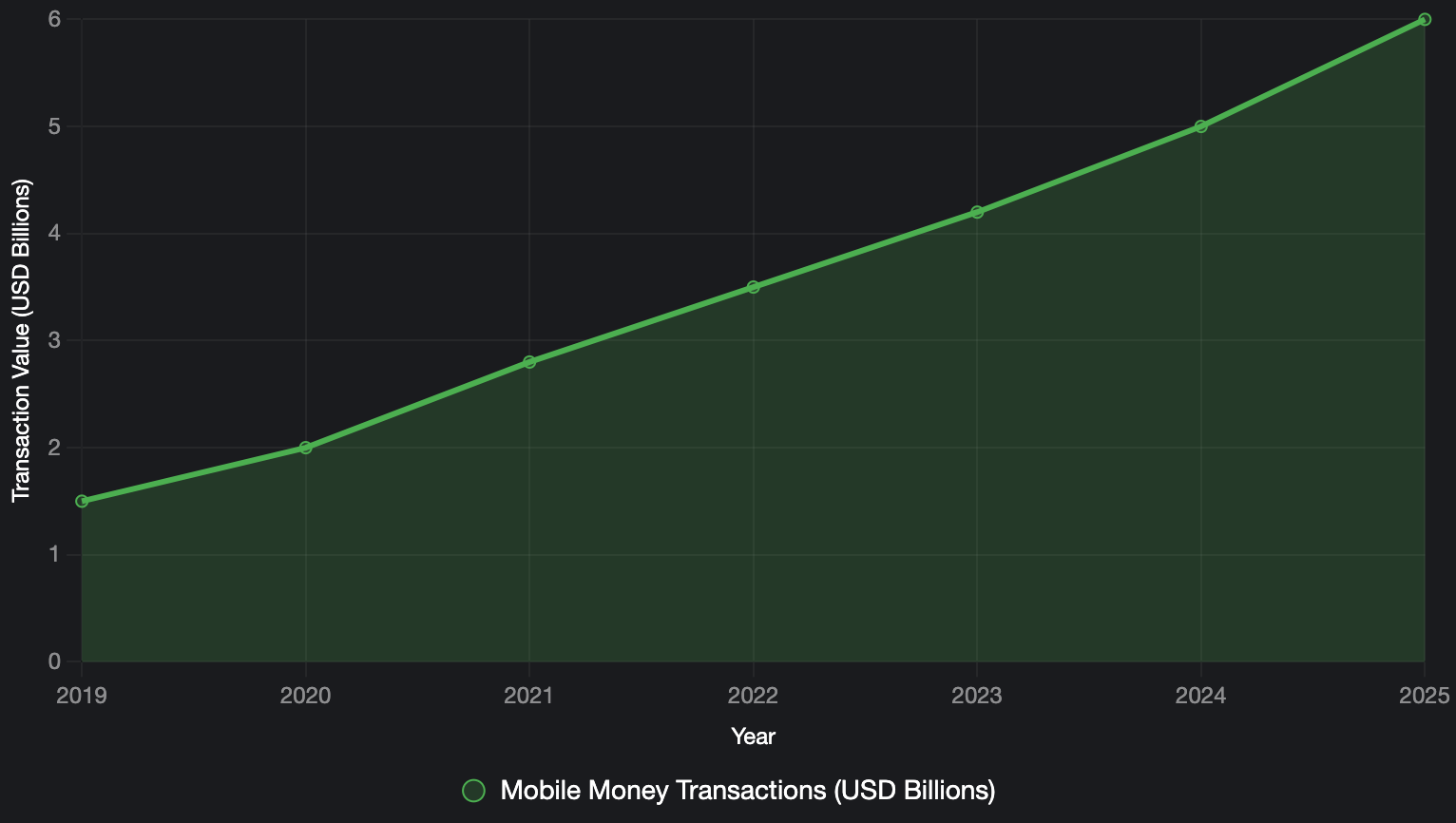

In 2025, Uganda’s fintech and digital economy continue to expand rapidly, driven by mobile money innovation, eCommerce, and foreign direct investment (FDI). As financial services digitize, regulators are placing greater emphasis on Know Your Business (KYB) compliance, ensuring that companies verify and monitor their business customers to prevent money laundering, fraud, and terrorist financing.

For fintechs, digital wallets, and other regulated entities, robust KYB processes are no longer optional. They are essential for regulatory compliance, risk assessment, and building trust in Uganda’s fast-growing financial ecosystem.

Regulatory Framework for KYB in Uganda

Uganda’s KYB requirements stem from a combination of anti-money laundering (AML), financial integrity, and company registration regulations.

Key institutions include:

- Bank of Uganda (BoU) – Supervises financial institutions and enforces AML and Customer Due Diligence (CDD) requirements under the Financial Institutions Act.

- Financial Intelligence Authority (FIA) – Established under the Anti-Money Laundering Act, 2013 (amended in 2022); oversees compliance programs, suspicious transaction reporting, and enforcement.

- Uganda Registration Services Bureau (URSB) – Maintains the national company registry and ensures transparency of beneficial ownership as per the Companies (Beneficial Ownership) Regulations, 2016.

- Capital Markets Authority (CMA) and Insurance Regulatory Authority (IRA) – Require licensed entities to perform CDD and KYB checks on clients and partners.

To illustrate these interconnected roles:

| Institution | Primary Role in KYB | Key Legislation |

|---|---|---|

| Bank of Uganda (BoU) | Supervises financial institutions, AML/CDD oversight | Financial Institutions Act |

| Financial Intelligence Authority (FIA) | Oversees AML reporting and enforcement | AML Act 2013 (amended 2022) |

| Uganda Registration Services Bureau (URSB) | Maintains beneficial ownership registry | Companies (BO) Regulations 2016 |

| Capital Markets Authority (CMA) | Ensures KYB for capital markets entities | Capital Markets Act |

| Insurance Regulatory Authority (IRA) | Enforces KYB for insurers | Insurance Act |

These bodies collectively define Uganda’s regulatory backbone, aligning the country’s AML and KYB regime with FATF and ESAAMLG standards.

Understanding the KYB Process in Uganda

The KYB process involves verifying the legal existence, ownership, and operations of business entities. Financial institutions must ensure they are not onboarding shell companies or businesses linked to illicit activity.

Typical KYB verification steps include:

- Business Registration Verification

Confirm company incorporation details via the URSB database.

Obtain the Certificate of Incorporation, Memorandum and Articles of Association, and TIN (Tax Identification Number). - Beneficial Ownership Identification

Identify all ultimate beneficial owners (UBOs) holding 10% or more ownership or control.

Collect national ID or passport copies and address details for each UBO. - Directors and Signatories Verification

Validate identities of company directors, shareholders, and authorized representatives through eKYC or national ID verification. - Operational and Risk Assessment

Review the business’s line of activity, source of funds, and geographical exposure.

Conduct ongoing due diligence and periodic reviews for higher-risk entities.

For fintechs and banks, these steps are increasingly being automated through API-based KYB systems, enabling faster onboarding and compliance consistency across customer segments.

Challenges and Opportunities

While Uganda’s regulatory framework is well-defined, implementation faces several challenges:

- Limited access to reliable corporate data: Over 70% of Ugandan businesses operate informally, according to recent World Bank–aligned studies. This informality not only hampers KYB but also exposes institutions to higher fraud risks. A 2024 BoU report noted a 15% rise in suspicious business onboardings, with compliance teams often spending weeks chasing manual verifications instead of focusing on innovation.

- Manual onboarding processes: Many financial institutions still rely on paper-based checks, slowing onboarding and increasing operational costs.

- Cross-border compliance complexities: Within the East African Community (EAC), differing enforcement standards and registry maturity levels complicate regional due diligence. Even with similar ownership thresholds (10%+), data quality and public access vary significantly.

Despite these hurdles, Uganda’s digital identity ecosystem continues to evolve. NIRA is expanding biometric coverage, and URSB is digitizing company records for better accessibility.

This digital transformation presents an opportunity for Uganda to position itself as a regional leader in compliance innovation combining stronger regulation with smarter, technology-driven verification.

Best Practices for Regulated Businesses

If you are a fintech, bank, or digital service provider in Uganda, here are key best practices to strengthen compliance and efficiency:

- Prioritize Enhanced Due Diligence (EDD) for high-risk entities, such as politically exposed businesses (PEPs) or those with complex ownership structures. For example, use automated screening to flag PEPs against FIA watchlists, then conduct manual source-of-wealth checks to mitigate sanctions risks.

- Automate verification where possible using trusted KYB and eKYC providers to reduce human error and onboarding delays.

- Integrate periodic monitoring, not just one-time checks, to detect ownership or activity changes in real time.

- Leverage risk-based approaches, aligning resources with customer risk profiles to balance compliance rigor and operational agility.

Applying these practices helps compliance teams remain efficient without compromising accuracy or regulatory standards.

How VOVE ID Supports KYB Compliance in Uganda

VOVE ID enables Ugandan fintechs, financial institutions, and digital platforms to automate their KYB and KYC workflows.

With integrations that leverage official registries and verified data sources, VOVE ID helps teams:

• Verify company details quickly using official URSB records

• Identify and screen directors and beneficial owners through eKYC tools

• Conduct AML risk assessments using global watchlist screening

• Simplify onboarding while supporting full regulatory compliance

By digitizing KYB processes, VOVE ID empowers businesses to cut compliance costs by up to 40%, enhance accuracy, and accelerate growth in Uganda’s fintech ecosystem.

Uganda was among the first East African countries to establish a central beneficial ownership register, aligning with FATF recommendations.

While Tanzania and Kenya are still strengthening their disclosure regimes, Uganda’s early move has positioned it as a regional transparency leader, attracting more FDI and cross-border partnerships.

Emerging Trends to Watch in 2025

Uganda’s KYB landscape is becoming more digitized and interconnected.

AI-driven risk scoring can analyze transaction patterns in real time, while blockchain-based registries, piloted by URSB in 2024, promise tamper-proof beneficial ownership data across EAC borders.

Regtech providers like VOVE ID are at the forefront of these innovations, collaborating with regulators such as the BoU to integrate secure KYB APIs that make compliance both smarter and faster.

Conclusion

If you are a fintech or bank in Uganda, embracing automated KYB is your gateway to faster growth, lower risk, and greater customer trust.

What if you could cut compliance costs by 40% while onboarding verified businesses in minutes?

Learn how our APIs can transform your KYB compliance workflow.