KYB for Stablecoins: A 2025 Guide for Compliance and Growth

Explore KYB and B2B stablecoin compliance in 2025: regulatory frameworks, challenges, and solutions for fintechs in Africa, MENA, and beyond. Build trust with robust business verification.

Stablecoins have evolved from niche tokens into a cornerstone of global payments and digital finance, facilitating billions in daily transactions. With a market capitalization of $251.7 billion in mid-2025, dominated by USDT at 68% ($112 billion), they enable cross-border commerce, remittances, and decentralized applications. Their adoption is surging, with $27 trillion in transactions in 2024, approaching card network volumes, per McKinsey, with USDT alone processing $1.14 trillion monthly.

In regions like Africa and the Middle East, where traditional banking often falls short, stablecoins are bridging critical gaps for both individuals and businesses. Yet, as adoption grows, so do risks: Chainalysis reports that 63% of illicit crypto activity in 2024 involved stablecoins. To address these risks, regulators are extending Know Your Business (KYB) requirements across the ecosystem. For stablecoin providers, exchanges, and wallet operators, KYB is no longer optional: it is a regulatory necessity and a strategic lever for building trust and scaling sustainably. Solutions like VOVE ID enable startups to implement fast, secure eKYB, ensuring compliance while fostering growth.

This guide explores why KYB matters for stablecoin businesses, the regulatory landscape, key challenges, and actionable strategies, with a focus on Africa and MENA.

Why KYB Matters for Stablecoins

Unlike KYC, which verifies individuals, KYB ensures that businesses, corporate clients, merchants, and partners, are legitimate and compliant. In the stablecoin ecosystem, this is crucial because:

- Trust and credibility: Business verification for stablecoins strengthens confidence among customers, partners, and regulators.

- Risk mitigation: KYB helps prevent money laundering, shell company misuse, and fraudulent merchant activity.

- Market access: Robust KYB unlocks partnerships with financial institutions and regulatory approval in key markets.

Stablecoins are increasingly used in B2B transactions, payroll, and merchant settlements. Without effective KYB, these advantages risk being overshadowed by exposure to fraud and regulatory penalties.

The Regulatory Landscape in 2025

Stablecoin regulation has accelerated, with KYB requirements now central to compliance frameworks:

- United States: The GENIUS Act (July 2025) introduces mandatory KYB checks for issuers and exchanges, alongside strict KYC and reserve requirements.

- European Union: MiCA requires stablecoin providers to conduct onboarding and due diligence on both individuals and corporate clients.

- Saudi Arabia: The Saudi Central Bank (SAMA) mandates UBO verification, annual compliance reviews, and ongoing due diligence for all Virtual Asset Service Providers (VASPs) since 2024, aligning with FATF standards.

- United Arab Emirates: The Payment Token Services Regulation (2024) requires corporate onboarding checks for all licensed stablecoin operators.

- Global Standards: FATF and the Financial Stability Board emphasize KYB for VASPs to reduce risks of shell entities and cross-border abuse.

For businesses in Africa and MENA, aligning with these standards is essential to attract partners and investors who demand international-grade compliance.

Key KYB Challenges in the Stablecoin Ecosystem

Implementing effective KYB presents unique hurdles:

- Complex corporate structures: Identifying UBOs across jurisdictions can be time-intensive and costly.

- Cross-border conflicts: Varying KYB requirements complicate compliance for businesses operating across multiple markets.

- Scalability issues: Manual KYB processes are resource-heavy and unsustainable for startups.

- Evolving regulations: Frameworks like GENIUS, MiCA, and the UAE’s Payment Token Services Regulation require frequent updates to onboarding and reporting processes.

- Balancing speed with compliance: Businesses need frictionless onboarding while ensuring robust verification.

Building an Effective KYB Program for Stablecoins

To meet these challenges, businesses can adopt a layered approach:

- Risk-Based KYB

Apply stricter checks for high-risk corporate entities while streamlining onboarding for low-risk merchants. - Digital Business Verification

Corporate onboarding for stablecoins is streamlined with eKYB solutions like VOVE ID, which verify company documents, registries, and UBOs in real time, ensuring compliance with global standards. - Integrated Compliance Workflows

Connect KYB with AML checks, sanctions screening, and reporting tools for a unified compliance strategy. - Scalability and Automation

Automate KYB checks to process high transaction volumes efficiently. - Compliance by Design

Build platforms that embed KYB requirements into onboarding flows, reducing the risk of oversight.

KYB as a Competitive Advantage

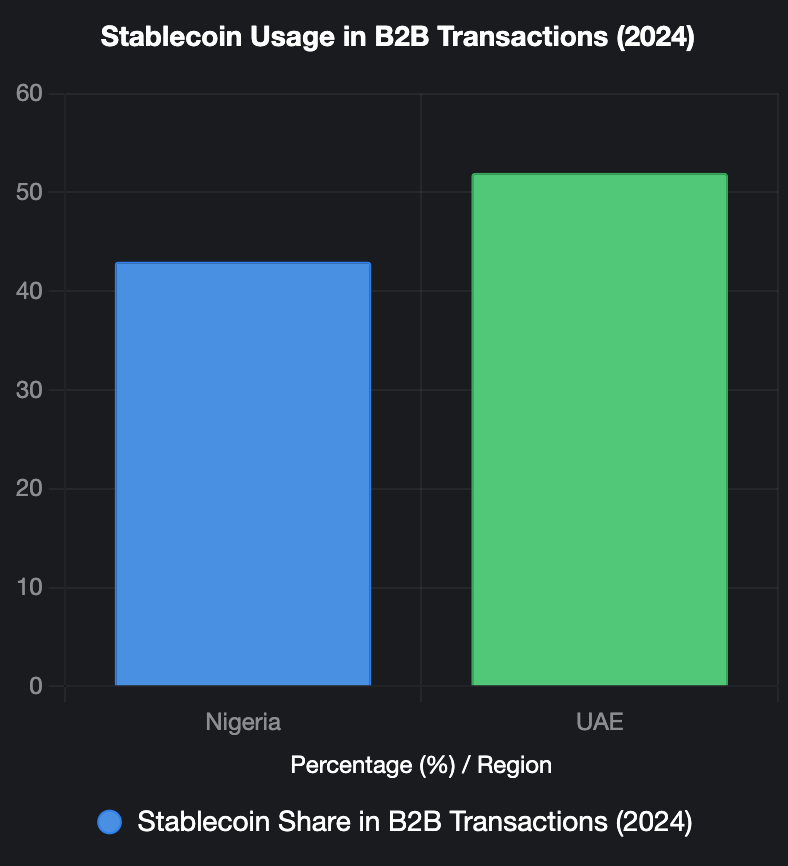

In emerging markets, where trust gaps are significant, strong KYB is more than compliance: it is a growth enabler. In Nigeria, 43% of crypto transactions, per Chainalysis, involve B2B payments, highlighting the need for robust KYB to verify corporate entities. In the UAE, digital assets worth $30 billion were received by mid-2024, with 52% in stablecoins involving corporate remittances and settlements, per Chainalysis. Across East Africa, mobile money penetration creates fertile ground for stablecoin adoption among businesses.

Solutions like VOVE ID provide startups in Africa and MENA with cost-effective, enterprise-grade eKYB verification, minimizing compliance costs while enabling focus on innovation.

Regional Relevance: Africa and MENA

Stablecoins serve critical business needs across these regions:

- Nigeria: Stablecoins drive $22 billion in B2B payments annually, with 43% of crypto transactions involving corporate entities, per Chainalysis.

- Gulf Countries: Migrant worker remittances and corporate payroll integration increasingly rely on stablecoins, with the UAE’s regulatory framework ensuring compliance.

- East Africa: Merchants and platforms integrate stablecoins into digital wallets for cross-border trade.

Proactive KYB ensures compliance with emerging local rules, such as the UAE’s Payment Token Services Regulation, while aligning with FATF, opening doors to investment and international partnerships.

Future of KYB in Stablecoins

The future of stablecoin compliance lies in compliance by design. Innovations such as blockchain-based corporate registries, verifiable credentials, and zero-knowledge proofs will enhance transparency while protecting privacy. As stablecoin transactions are projected to exceed $27 trillion in 2025, per McKinsey, robust KYB will be indispensable for trust and scalability. Partnerships with providers like VOVE ID will become standard, allowing startups to achieve compliance efficiently while focusing on growth.

Conclusion

Stablecoins are redefining digital payments in 2025, but their long-term potential depends on strong KYB. By adopting risk-based business verification, leveraging eKYB, automating processes, and embedding compliance, businesses can navigate regulatory complexity while scaling sustainably. For startups in Africa, MENA, and beyond, KYB is not a burden but a catalyst for credibility, partnerships, and sustainable growth in the evolving stablecoin ecosystem.

Start integrating robust KYB solutions like VOVE ID today to unlock growth, ensure compliance, and stay ahead of 2025’s regulatory demands in the fast-evolving stablecoin ecosystem.