AML Compliance in South Africa: A 2025 Guide for Fintechs and Regulated Businesses

Discover South Africa’s 2025 AML compliance landscape. Learn how fintechs and crypto platforms can meet FICA, POCA, and FATF requirements, navigate grey listing, and scale securely.

South Africa, a financial hub driving Africa’s fintech boom, faces mounting pressure to combat money laundering and terrorist financing. Its FATF greylisting in February 2023 has spurred stricter regulations in 2025, making AML compliance critical for fintechs, crypto platforms, and regulated startups. This guide unpacks South Africa’s AML landscape, offering practical steps to stay compliant, manage risks, and scale responsibly while highlighting tools like VOVE ID to streamline compliance.

Why AML Matters in South Africa

South Africa’s vibrant economy, home to the Johannesburg Stock Exchange (JSE) and a thriving fintech sector, processes billions in transactions yearly. Yet, its cash-heavy markets, porous borders, and sophisticated criminal networks make it a target for financial crime, from cross-border syndicates to digital fraud. The Financial Action Task Force (FATF) greylisted South Africa in 2023 due to gaps in beneficial ownership transparency and enforcement, prompting the 2025 AML/CTF Amendment Bill to align with global standards and target a 2026 delisting.

For fintechs and crypto asset service providers (CASPs), robust AML programs are non-negotiable. Compliance builds trust, attracts investors, and ensures access to global markets, while failures risk hefty fines and reputational damage.

Regulatory Framework & Core Obligations

South Africa’s AML/CFT regime, overseen by the Financial Intelligence Centre (FIC), South African Reserve Bank (SARB) Prudential Authority, and Financial Sector Conduct Authority (FSCA), is anchored by key laws:

Core Legislation

- Financial Intelligence Centre Act (FICA, 2001): Mandates customer due diligence (CDD), suspicious transaction reporting (STRs), and risk-based compliance for accountable institutions like banks, fintechs, crypto platforms, and estate agents.

- Prevention of Organised Crime Act (POCA, 1998): Criminalizes money laundering with penalties up to 30 years imprisonment or R100 million fines.

- Protection of Constitutional Democracy Against Terrorist and Related Activities Act (POCDATARA, 2004): Strengthens counter-terrorism financing measures.

- 2025 AML/CTF Amendment Bill: Expands crypto oversight, enhances beneficial ownership disclosure, and bolsters FIC’s supervisory powers.

✅ Key Compliance Requirements

Accountable institutions must:

- Register with the FIC via the goAML platform and appoint a compliance officer.

- Develop a Risk Management and Compliance Programme (RMCP) tailored to their risk profile, per FIC Guidance Note 7A.

- Conduct Customer Due Diligence (CDD):

- Verify identities (Smart ID, passport, proof of address).

- Identify beneficial owners (BOs) with ≥25% ownership or control.

- Apply Enhanced Due Diligence (EDD) for Politically Exposed Persons (PEPs) and high-risk clients.

- Monitor transactions and file:

- Suspicious Transaction Reports (STRs) within 15 days.

- Cash Transaction Reports (CTRs) for transactions above R24,999.99.

- Retain records for at least 5 years for audits and regulatory access.

Supervisory Bodies

- FIC: Leads AML/CFT enforcement, conducts inspections, and shares intelligence.

- SARB Prudential Authority: Regulates banks, insurers, and remittance services.

- FSCA: Oversees non-bank entities, including fintechs and CASPs.

Fintech & Crypto: Greylisting and Travel Rule Challenges

The FATF greylisting has intensified scrutiny on fintechs and CASPs, with the 2025 AML/CTF Amendment Bill and Directive 9 (Travel Rule), effective April 30, 2025, introducing stricter controls. South Africa has addressed 16 of 22 FATF action items, focusing on BO transparency and STR filings, with remaining gaps in law enforcement coordination.

✅ Key Updates

- Directive 9 (Travel Rule): CASPs must collect and share originator and beneficiary details (e.g., name, ID, wallet address) for crypto transactions above R5,000, aligning with FATF’s Travel Rule.

- Greylisting Priorities: Enhanced supervision and real-time monitoring are critical to exit the grey list by 2026.

Fintechs must adopt robust transaction monitoring to comply with FATF’s 40 Recommendations and avoid penalties. Tools like VOVE ID streamline Travel Rule compliance with real-time analytics and identity verification.

KYC & eKYC: Streamlining Onboarding

Effective Know Your Customer (KYC) processes balance compliance with customer experience. South Africa’s KYC market is growing at a CAGR of ~22.7%, driven by demand for digital onboarding.

KYC Requirements

- Individuals: Verify identity using Smart ID, passport, or driver’s license, plus proof of address (e.g., utility bill, bank statement).

- Corporates: Collect entity documents, UBO details, tax certificates, and source-of-funds evidence.

- High-Risk Clients: Conduct EDD, including PEP screening and re-verification every three years.

eKYC Benefits

- AI-Driven Verification: Biometric facial liveness checks and document authentication reduce fraud and false positives.

- Lower Churn: Streamlined onboarding cuts dropout rates (up to 74% for complex KYC flows) and boosts financial inclusion.

- Compliance Efficiency: Automated PEP and sanctions screening ensures FICA adherence.

Technology & Innovation: Powering AML Compliance

As financial crime evolves, traditional systems struggle with complex laundering patterns. RegTech solutions are transforming AML compliance in South Africa.

- AI and Machine Learning: Platforms like VOVE ID and Tookitaki use graph learning to detect suspicious patterns, reducing false positives by up to 30%.

- Blockchain Analytics: VOVE ID’s tools enable real-time transaction tracing and Travel Rule compliance for CASPs.

- Automated Case Management: Streamlines STR/CTR filings and audit trails for FIC compliance.

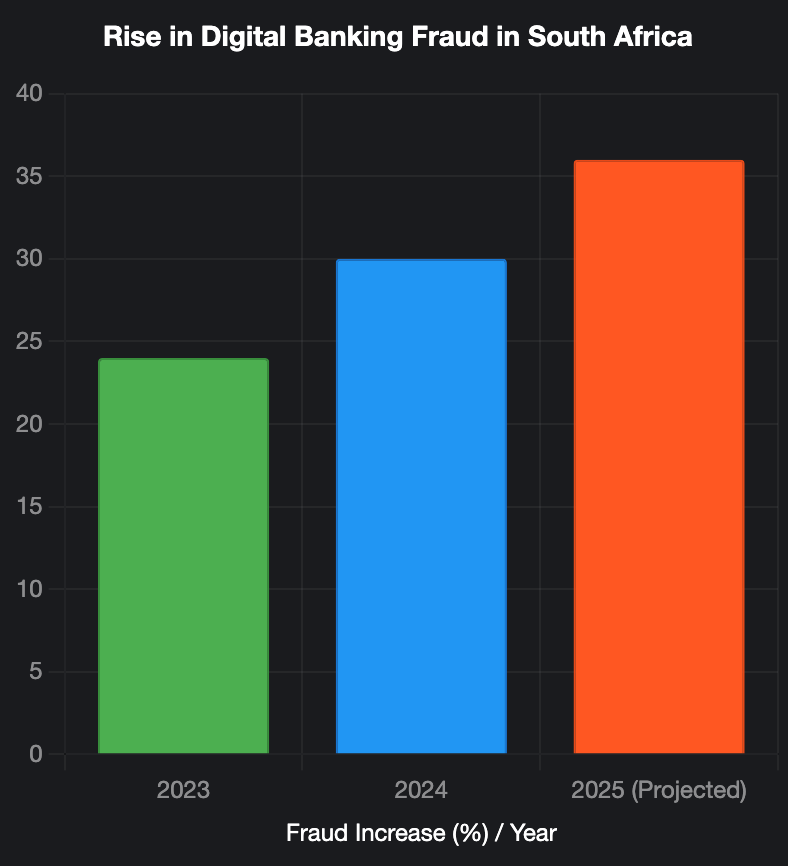

Chart: Rise in Digital Banking Fraud

The chart below illustrates the 24–36% year-on-year surge in digital banking fraud, underscoring the need for advanced AML solutions.

Risks & Penalties: The Cost of Non-Compliance

Regulatory Penalties

- Fines: Old Mutual (R15.9M) and HSBC (R9.5M) faced penalties for FICA violations.

- Criminal Sanctions: POCA violations carry fines up to R100 million or 30 years imprisonment.

- Reputational Harm: Non-compliance erodes trust and limits global market access.

Operational Challenges

- Rising Fraud: Digital banking fraud has surged 24–36% year-on-year.

- Inconsistent KYC: Varying standards increase onboarding friction and churn.

- Resource Gaps: Smaller fintechs struggle with advanced AML system costs.

Compliance Checklist for Fintech Startups

Here’s a blueprint for a robust AML program:

| Step | Action |

|---|---|

| Register with FIC | Enroll via goAML; appoint a compliance officer. |

| Develop RMCP | Create a Risk Management and Compliance Programme per FIC Guidance Note 7A. |

| Implement KYC/eKYC | Use AI-driven tools like VOVE ID for ID verification, biometric checks, and PEP/sanctions screening. |

| Monitor Transactions | Deploy AI or graph-based systems for real-time detection of laundering patterns. |

| File Reports | Submit STRs (within 15 days) and CTRs (above R24,999.99); retain records for 5 years. |

| Train Staff & Audit | Conduct regular AML training; perform internal audits. |

| Stay Updated | Monitor updates like Directive 9 and the AML/CTF Amendment Bill; adapt RMCP. |

The Way Forward: Compliance as a Competitive Edge

In 2025, AML compliance is a strategic advantage for South African fintechs. By leveraging RegTech like VOVE ID, startups can:

- Reduce Costs: AI-driven tools lower compliance overheads.

- Enhance User Experience: Seamless eKYC flows reduce churn and drive inclusion.

- Build Trust: Robust AML programs attract investors and global partners.

- Support Delisting: Strong compliance aids South Africa’s FATF grey list exit.

Ready to streamline your AML program? Explore solutions like VOVE ID to ensure compliance and scale confidently in South Africa’s dynamic financial landscape.