KYB Compliance in Angola: 2025 Guide for Regulated Businesses

Discover how to navigate KYB compliance in Angola with this 2025 guide. Learn about AML regulations, UBO verification, digital KYB tools, and best practices for regulated businesses.

Angola’s resource-rich economy continues to attract significant foreign investment, particularly in sectors such as oil, infrastructure, and mining. The country’s strategic position and ongoing economic reforms make it an appealing destination for international businesses. However, operating in Angola requires a deep understanding of local regulatory requirements, especially in the area of Know Your Business (KYB) compliance. KYB is not merely a regulatory checkbox — it is a critical safeguard against operational, financial, and reputational risks.

Understanding KYB in Angola

KYB (Know Your Business) is a fundamental component of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) frameworks. It involves verifying the legal status, ownership structures, and risk profiles of business clients before and during the business relationship. In Angola, these obligations are mandatory for banks, payment providers, insurers, and other regulated entities under the supervision of the Banco Nacional de Angola (BNA).

Angola is a member of the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) and aligns its AML policies with international standards set by the Financial Action Task Force (FATF). However, as of 2025, the country fully complies with only a limited number of FATF recommendations. Many areas, particularly enforcement and transparency, still require improvement. This makes robust internal controls and a proactive approach to KYB all the more important.

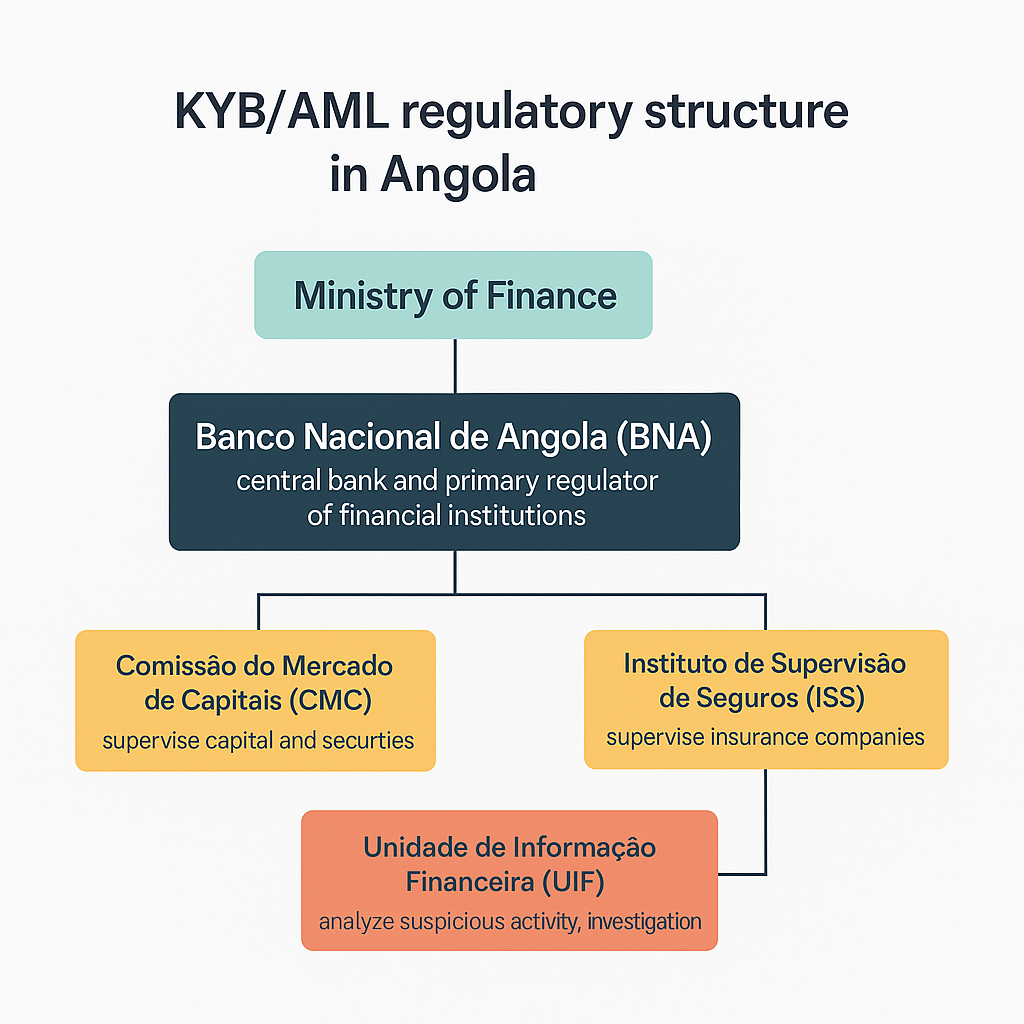

Angola's Regulatory Structure: Who Governs KYB?

Financial oversight in Angola is carried out by several key institutions:

- Ministry of Finance – Responsible for setting macroeconomic and financial policies.

- Banco Nacional de Angola (BNA) – Central bank and primary financial regulator.

- Capital Markets Commission (CMC) – Oversees securities and stock exchange activities.

- Insurance Supervision Institute (ISS) – Supervises the insurance sector.

- Financial Intelligence Unit (UIF) – Handles suspicious transaction reporting and AML/CFT coordination.

Understanding the role of each body helps businesses stay aligned with local compliance requirements.

Regulatory Expectations and Required Documents

To onboard a business client in Angola, companies must collect and verify a comprehensive set of documents proving the entity’s legitimacy. These usually include:

- Certificate of incorporation or registry extract from the Direcção dos Serviços de Empresas (DSE)

- Articles of Association

- Tax Identification Number (Número de Identificação Fiscal, NIF) from the General Tax Administration (AGT)

- Proof of registered office address

- Audited financial statements

- Identification documents for directors and shareholders

- Any applicable sector-specific licenses (e.g., from ANPG for oil & gas or ANRM for mining)

Entities classified as high risk — such as those with politically exposed persons (PEPs) or complex ownership structures — require enhanced due diligence and ongoing monitoring.

UBO Identification and Transparency Gaps

One of the biggest challenges in Angola is the identification of Ultimate Beneficial Owners (UBOs). While some company information is accessible through the Portal das Empresas, shareholder and UBO data are often limited or unavailable. There is currently no public UBO register in Angola. As a result, businesses must often rely on manual tracing or external tools to verify ownership.

UBO verification is critical for preventing money laundering and corruption. Many firms turn to trusted platforms like VOVE ID to automate screening and ownership analysis.

Practical Challenges in Business Verification

Conducting KYB in Angola comes with a number of practical challenges:

- Public data is limited and not always accessible in real time.

- Verifying physical documents may involve bureaucratic delays.

- All documentation is in Portuguese, requiring translation or local expertise.

- Corruption risks remain present despite ongoing reforms.

- Some licenses must be verified across separate agencies depending on the business sector.

These issues can significantly slow down onboarding and increase compliance risks if not addressed properly.

Digital Transformation: Progress and Limitations

Angola has started to invest in digital public infrastructure, but progress is still limited. The country currently ranks low in the UN’s E-Government Development Index (156th). That said, businesses are increasingly adopting digital solutions to enhance compliance.

Platforms like VOVE ID can help companies automate verification workflows, reduce manual errors, and ensure audit-ready documentation — even in jurisdictions with limited access to structured data.

Best Practices for KYB Compliance in Angola

To meet local requirements and reduce compliance risks, businesses should:

- Apply a risk-based approach that focuses resources on higher-risk entities.

- Work with local legal experts familiar with Portuguese documentation and procedures.

- Use digital tools to automate checks and maintain documentation standards.

- Regularly update ownership and licensing data.

- Provide compliance training to relevant staff.

- Maintain a detailed audit trail for all verification steps.

Penalties for Non-Compliance

Firms that fail to comply with KYB obligations may face:

- Financial penalties

- Suspension or revocation of licenses

- Reputational damage

- Regulatory blacklisting

- Business disruption

Even with limited enforcement capacity today, these consequences remain a serious risk.

Strengthening Internal Controls

Companies operating in Angola should establish robust internal controls, including:

- Clearly defined KYB policies and procedures

- Regular internal audits

- Staff training on document validation and red flags

- Centralized systems for compliance tracking

- Alignment with international AML standards

FAQ: KYB Compliance in Angola

🔍What is the biggest challenge with KYB in Angola?

The biggest challenge is the lack of access to reliable public data, particularly regarding ownership and UBO information. This makes it difficult to verify business structures efficiently.

🔍Is eKYC allowed in Angola?

While there is no formal regulation specific to eKYC, digital tools are increasingly accepted in practice. Solutions that offer clear documentation, audit trails, and reliable data sources can help businesses remain compliant.

🔍Do foreign companies need to comply with local KYB rules?

Yes. Any company offering financial or regulated services in Angola must comply with national AML and KYB requirements, regardless of whether they are based locally or abroad.