KYB Compliance in Côte d'Ivoire: 2025 Guide for Fintech & PSPs

Discover how fintechs and PSPs verify businesses in Côte d'Ivoire. Learn about KYB using RCCM, CENTIF guidelines, and VOVE ID for secure onboarding.

Why KYB Matters in Côte d'Ivoire

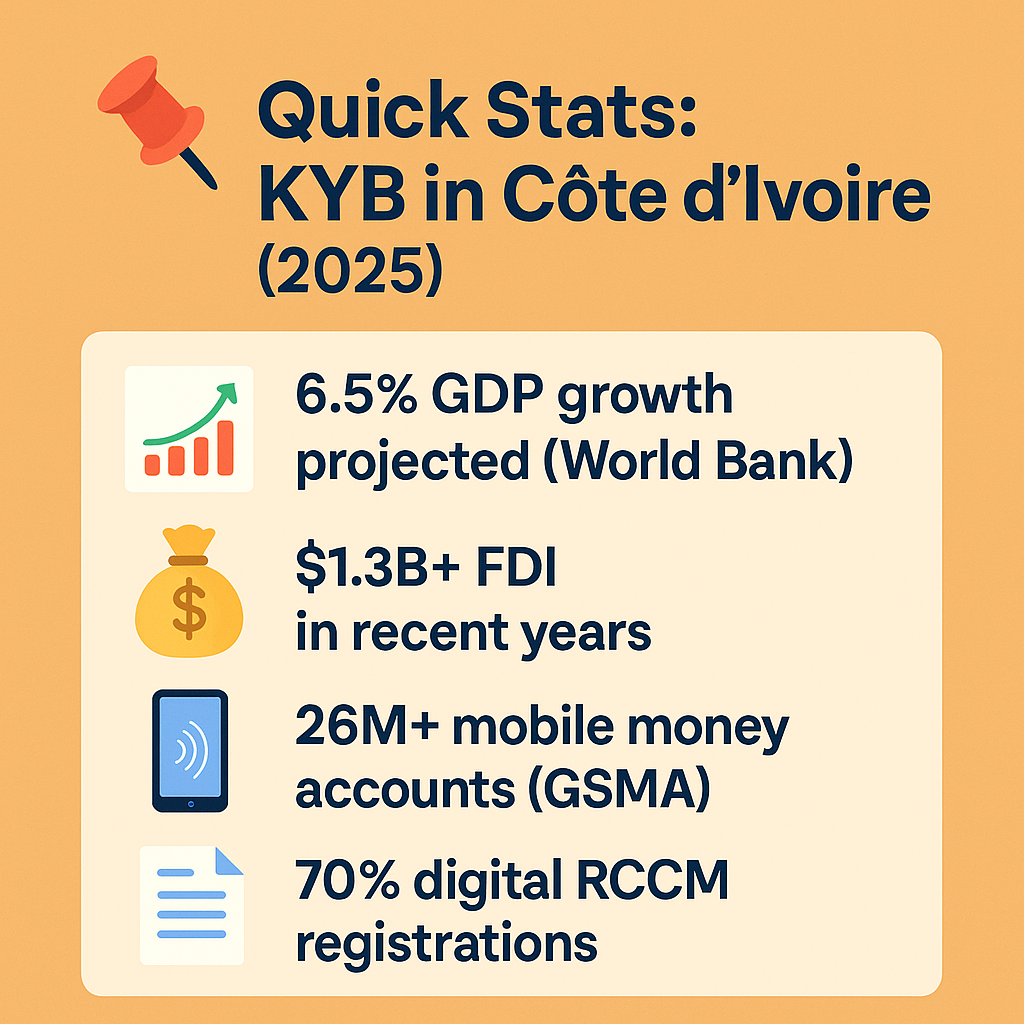

Côte d'Ivoire is a fintech powerhouse in West Africa, driven by a mobile money boom with over 26 million accounts in 2023 (GSMA) and a projected GDP growth of 6.5% in 2025 (World Bank). As a hub for digital wallets and payment service providers (PSPs), the country is attracting significant investment, making Know Your Business (KYB) essential for verifying merchants, partners, and vendors. KYB ensures compliance with Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) regulations, prevents fraud, and fosters trust in Côte d'Ivoire’s digital economy.

This guide explores KYB requirements, key regulators, digital trends, and solutions for fintechs and regulated businesses in 2025.

The Regulatory Landscape for KYB in Côte d'Ivoire

Côte d'Ivoire’s KYB framework aligns with national and regional AML/CFT standards, overseen by:

- CENTIF-CI (Cellule Nationale de Traitement des Informations Financières): The Financial Intelligence Unit (FIU) enforces AML/CFT rules, requiring KYB and Customer Due Diligence (CDD) for financial institutions and filing of suspicious transaction reports (STRs).

- BCEAO (Banque Centrale des États de l’Afrique de l’Ouest): The West African Economic and Monetary Union (WAEMU) central bank sets KYB standards for banks, e-money issuers, and PSPs through regulations like Instruction n°001-01-2024.

- OHADA & RCCM: The Organisation for the Harmonization of Business Law in Africa (OHADA) provides a unified commercial code. Businesses must register in the Registre du Commerce et du Crédit Mobilier (RCCM), Côte d'Ivoire’s company registry, for legal and ownership verification.

- Ministère de l'Économie et des Finances: Oversees AML/CFT strategy, collaborating with CENTIF to improve beneficial ownership transparency, though a centralized Ultimate Beneficial Owner (UBO) register is still under development.

- GIABA & FATF: Through GIABA, Côte d'Ivoire adheres to the Financial Action Task Force’s (FATF) 40 Recommendations. FATF’s 2023 report noted progress but highlighted gaps in addressing money laundering risks tied to legal entities.

These bodies ensure compliance for banks, fintechs, real estate, and cross-border trade sectors.

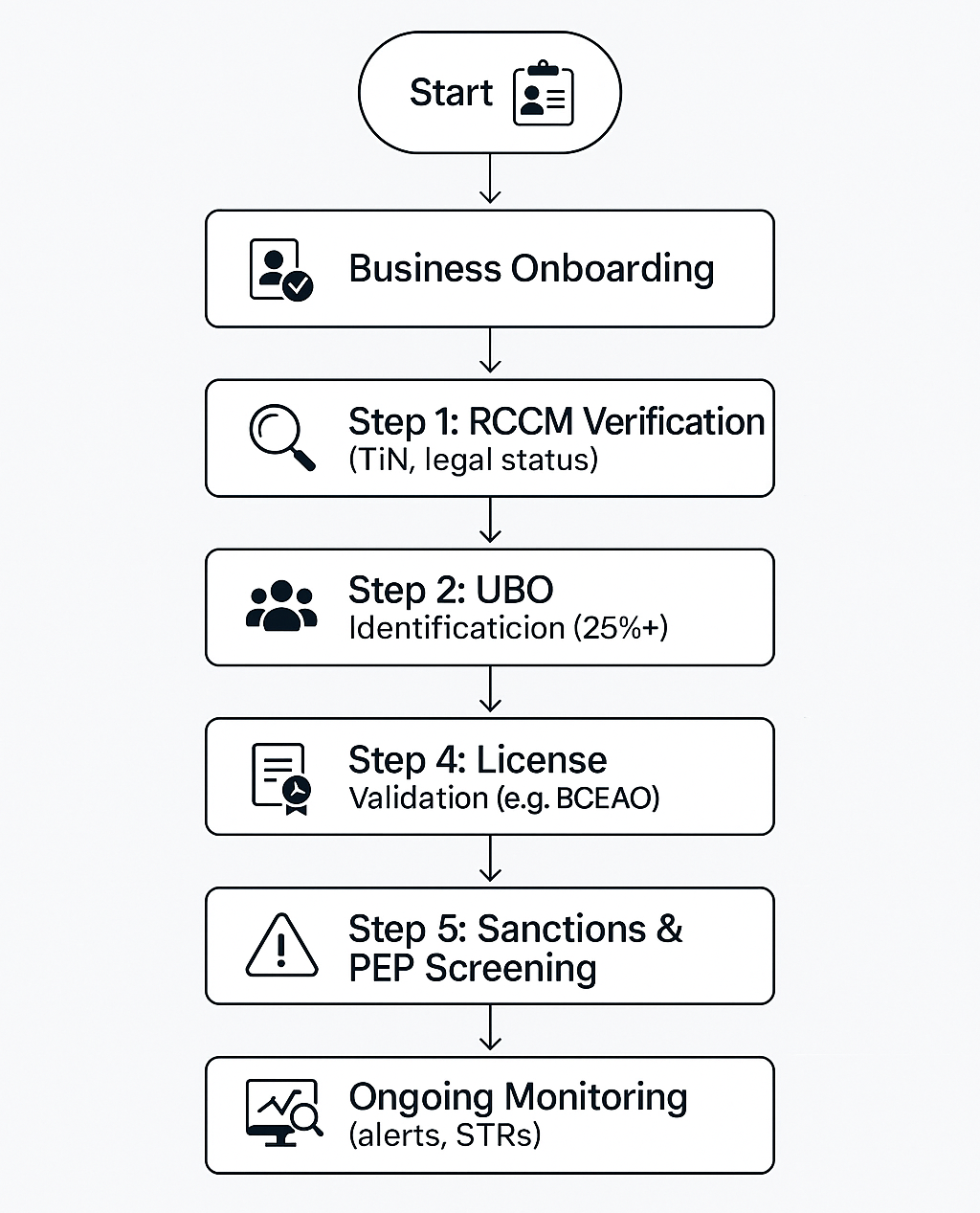

What KYB Means in Practice

KYB verifies the legitimacy, ownership, and activities of business entities before establishing commercial relationships. Key steps include:

- Confirming Legal Existence: Validate registration details in the RCCM, including the Tax Identification Number (TIN) and legal status.

- Identifying Beneficial Owners: Identify natural persons with significant ownership (typically 25% or more) or control, using self-declarations or enhanced CDD in high-risk cases.

- Validating Licenses & Business Purpose: Confirm regulatory approvals (e.g., BCEAO licenses for fintechs) and alignment with stated business activities.

- Ongoing Monitoring: Periodically re-verify partners, monitor transactions for anomalies, and file STRs with CENTIF-CI for suspicious activities.

For example, a PSP onboarding a cocoa exporter must verify RCCM registration, check UBOs against sanctions lists, and monitor transactions above 5M CFA for red flags.

Why KYB Is Crucial in Côte d'Ivoire

KYB is a cornerstone of Côte d'Ivoire’s financial ecosystem:

- AML/CFT Compliance: KYB prevents misuse by shell companies, a focus for CENTIF and BCEAO in sectors like real estate and informal trade.

- Global Credibility: FATF alignment via GIABA strengthens Côte d'Ivoire’s reputation for international partnerships and correspondent banking.

- Business Integrity: With $1.3B in FDI, a verified business ecosystem reduces risks for investors, fostering trust and economic growth.

- Risk-Based Approach: BCEAO mandates risk classification for business clients, tailoring KYB depth to industry, location, or transaction volume.

Non-compliance risks fines up to 100M CFA, license suspension, or legal action under Law No. 2016-992.

Digital KYB Trends in Côte d'Ivoire

Côte d'Ivoire is advancing digital KYB, driven by fintech innovation and regulatory reforms:

- RCCM Digitization: Since OHADA’s 2019 reforms, ~70% of new company registrations are digital, with partial access via portals like cepici.gouv.ci. Full API access is still limited.

- Mobile Money Boom: With 26M+ mobile money accounts, PSPs are digitizing merchant KYB, using mobile-first onboarding for SMEs.

- API-Driven Verification: Fintechs leverage third-party tools for RCCM and sanctions checks, though comprehensive registry APIs are not yet widespread.

- AI and Automation: AI streamlines document extraction, UBO identification, and risk scoring, cutting verification times by up to 40%.

BCEAO’s Fintech Committee and regulatory sandboxes are paving the way for faster KYB by 2026.

KYB in Action: Onboarding a Retail Merchant

Consider a PSP in Abidjan onboarding an electronics retailer. The KYB process includes:

- Pulling RCCM Records: Verify TIN and registration via the RCCM portal or CEPICI.

- Checking Ownership: Identify UBOs through shareholder declarations, screening against PEP and sanctions lists (e.g., UN, WAEMU).

- Validating Licenses: Confirm trade permits and sector compliance.

- Monitoring Transactions: Set alerts for transactions above 5M CFA, filing STRs with CENTIF-CI if irregularities appear (e.g., frequent high-value transfers).

Merchants in high-traffic commercial areas may require enhanced checks due to cash-intensive operations.

Côte d'Ivoire’s RCCM began digitizing in 2019 under OHADA reforms. By 2024, ~70% of new registrations are digital, cutting KYB verification times by up to 40% with tools like VOVE ID.

KYB Challenges in Côte d'Ivoire

KYB faces several hurdles:

- Limited UBO Data: Without a centralized UBO register, businesses rely on self-declarations, increasing fraud risks.

- Registry Inconsistencies: Partial RCCM digitization means manual searches or in-person verifications are often needed, especially outside Abidjan.

- Language Barrier: Legal documents in French require localized KYB tools for seamless processing.

- Fragmented Oversight: Overlaps between CENTIF, BCEAO, and local authorities complicate reporting.

- Informal Sector: Verifying unregistered SMEs in Côte d'Ivoire’s large informal economy is challenging.

📌 Ghana’s Economic Growth and KYB’s Role

📌 How KYB Is Powering Nigeria’s Business Growth

How VOVE ID Supports KYB in Côte d'Ivoire

KYB can be complex, but VOVE ID simplifies it for fintechs, PSPs, and digital platforms. Our solution offers:

- AI-Driven Document Extraction: Pulls RCCM data, TINs, and corporate documents automatically.

- Real-Time Compliance Checks: Screens against PEP lists, UN/WAEMU sanctions, and adverse media instantly.

- UBO Identification Workflows: Streamlines beneficial owner verification in low-data environments with risk-based scoring.

- French-Localized Onboarding: Mobile-first, API-driven platform tailored for Côte d'Ivoire’s 98% mobile internet users.

- Audit-Ready Trails: Generates compliant logs for CENTIF-CI and BCEAO inspections.

From Abidjan’s bustling markets to rural SMEs, VOVE ID ensures fast, secure, and compliant onboarding. Request a demo at VOVE ID.

❓ Is KYB mandatory in Côte d'Ivoire?

Yes, financial institutions, e-money issuers, and PSPs must conduct KYB under BCEAO and CENTIF-CI AML/CFT guidelines.

❓ Where can I verify a business in Côte d'Ivoire?

Use the RCCM via online portals (e.g., entreprises.ci) or CEPICI, and validate licenses through BCEAO or relevant ministries.

❓ Does Côte d'Ivoire have a UBO register?

Not fully. Businesses must collect ownership declarations and apply enhanced due diligence for non-transparent entities.

❓ What are the penalties for non-compliance?

Fines up to 100M CFA, license suspension, or legal action, depending on the violation’s severity.

Conclusion: Mastering KYB for Growth and Trust

KYB compliance in Côte d'Ivoire is a foundation for secure, scalable growth in West Africa’s fintech hub. With regulations from CENTIF-CI, BCEAO, and OHADA, and a digitizing RCCM, tools like VOVE ID empower businesses to verify partners efficiently while meeting AML/CFT standards. By streamlining RCCM checks, UBO identification, and transaction monitoring, VOVE ID helps fintechs and PSPs build trust and seize opportunities in 2025. Start simplifying your KYB at VOVE ID.