KYC & AML Compliance in the USA: 2025 Guide for Financial Institutions

Discover 2025 KYC and AML compliance best practices in the U.S., including BSA and CDD Rule requirements, identity verification strategies, and digital onboarding solutions.

Why KYC & AML Are Essential in the USA Today

In the U.S., where financial crimes such as money laundering and identity fraud continue to rise, Know Your Customer (KYC) in the USA is a critical safeguard. KYC ensures financial institutions verify customers’ identities, preventing illicit activities and ensuring compliance. In 2024, global regulators imposed significant AML/KYC-related penalties. Failure to comply also risks reputational damage and lost business opportunities. This guide outlines KYC requirements, steps, and strategies to streamline compliance for secure operations in 2025.

What Is KYC and Why Is It Required?

KYC verifies a customer’s identity—whether an individual or legal entity representative—along with their risk profile and financial behavior to ensure legitimacy. It prevents crimes like money laundering, terrorist financing, and fraud, protecting businesses and the U.S. financial system. KYC is governed by anti-money laundering (AML) laws, including the Bank Secrecy Act (BSA) and USA PATRIOT Act, enforced primarily by FinCEN, along with FinCEN’s Customer Due Diligence (CDD) Rule.

The CDD Rule, effective since May 2018, requires financial institutions to identify and verify beneficial owners of legal entity customers, often individuals with significant control. Non-compliance can lead to fines, legal action, or eroded trust. KYC in the USA is essential for regulatory adherence and security.

With a clear understanding of KYC’s purpose, let’s explore who must comply.

Who Needs to Comply with KYC in the USA?

KYC applies to “covered financial institutions” under the BSA, defined as entities like banks, credit unions, and brokers that must maintain AML programs (FinCEN’s legal definitions). This includes:

- Banks and credit unions

- Fintech and money service businesses (MSBs)

- Securities firms and broker-dealers

- Insurance providers

- Cryptocurrency exchanges

Non-regulated businesses, such as retailers or tech firms, may adopt KYC voluntarily to mitigate fraud risks, especially when partnering with regulated entities or operating in high-risk sectors like international trade.

Key KYC Requirements in the USA

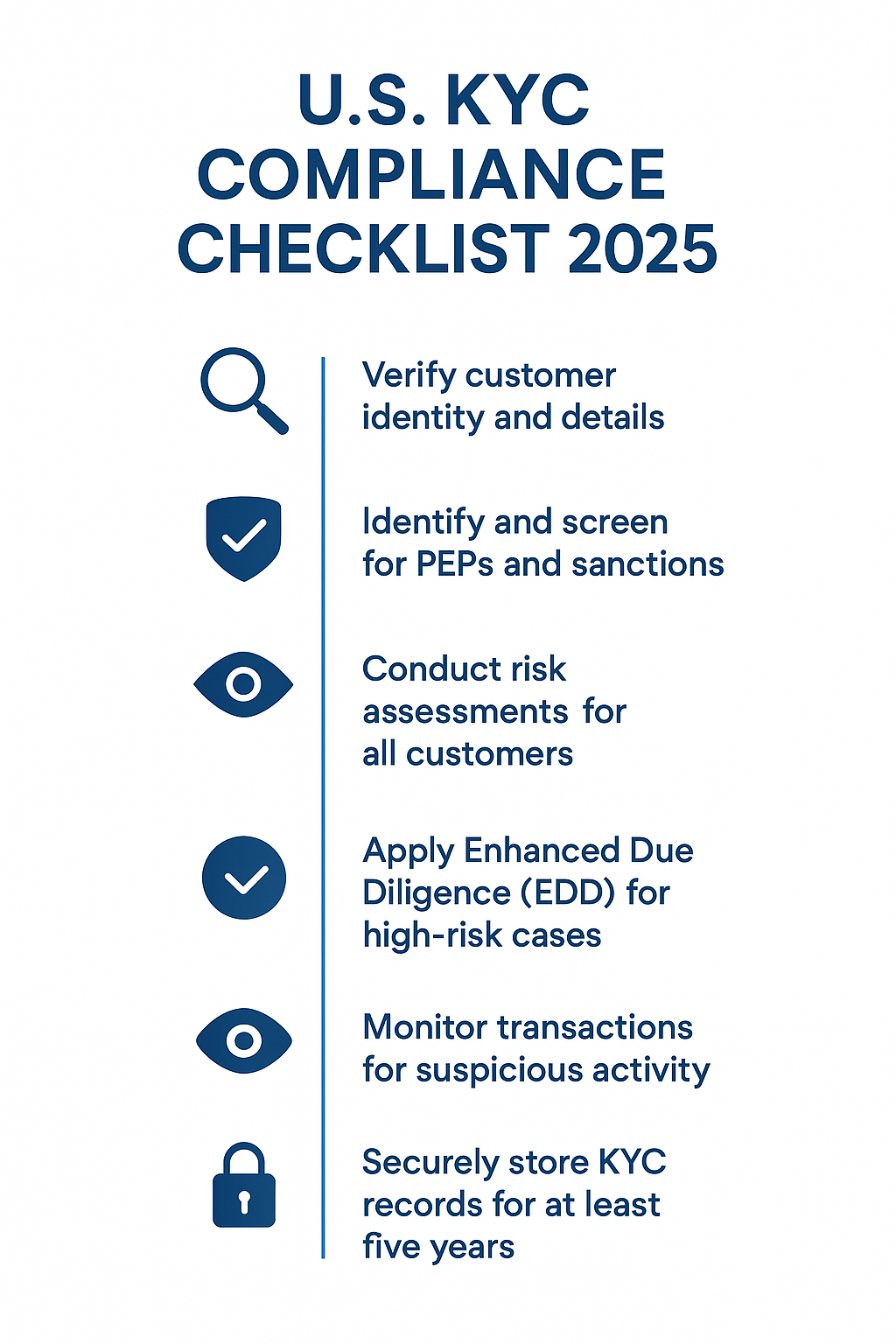

To meet U.S. KYC standards, businesses must:

- Collect: Gather customer details like full name, date of birth, address, and Social Security Number (SSN) or other government-issued ID.

- Verify: Confirm identity using reliable sources like government databases, credit bureaus, or digital KYC platforms.

- Screen: Check customers against sanctions lists, politically exposed persons (PEPs), and adverse media for red flags.

- Assess: Evaluate risks based on customer behavior, transaction patterns, or geographic ties, applying Enhanced Due Diligence (EDD) for high-risk cases. This is critical in the U.S. due to stringent regulatory oversight and evolving compliance demands, aligning with the CDD Rule’s risk-based approach.

- Monitor: Track customer transactions for suspicious activity, updating profiles as risks like new sanctions emerge.

- Store: Keep KYC records for five years after a relationship ends, per BSA rules.

Digital KYC tools automate these steps, ensuring efficiency and compliance.

Now that we’ve outlined the critical KYC steps, let’s examine common hurdles businesses face.

Challenges of KYC Compliance in the USA (and How to Overcome Them)

KYC compliance presents challenges:

- Regulatory Complexity: With regulatory changes rolling out rapidly, keeping pace with updates to the BSA, PATRIOT Act, and CDD Rule adds complexity.

- Data Accuracy: Inconsistent or incomplete customer data can hinder verification, especially for global clients.

- Cost and Time: Manual KYC processes are costly and slow, straining smaller firms.

- Client Experience: Lengthy onboarding can frustrate customers, risking drop-offs.

Automated KYC platforms and continuous staff training on regulations and tools streamline processes, reduce costs, and ensure accuracy. Want to simplify compliance? Book a free demo with VOVE ID to meet 2025 KYC standards with confidence.

Let’s explore how to streamline compliance with the right tools and strategies.

Streamlining KYC Compliance in the USA: Best Practices

Optimize KYC with these strategies:

- Leverage Automation: Use eKYC software for real-time ID verification and sanctions checks.

- Screen for Risks: Check PEPs, sanctions, and adverse media to identify issues early.

- Train Staff Continuously: Keep teams updated on regulations to spot fraud, like mismatched identities.

- Collaborate with Partners: Work with banks or KYC platforms for reliable data.

- Stay Informed: Monitor FinCEN updates and evolving AML requirements.

Partnering with VOVE ID delivers secure, U.S.-tailored KYC solutions.

Mini-FAQ on KYC in the USA

- ❓ Can non-financial U.S. companies skip KYC?

While not legally required, non-financial firms adopt KYC to reduce fraud risks, especially in high-risk sectors. - ❓ How is KYC evolving with digital identity?

Digital identity solutions, like biometrics and blockchain, are enhancing KYC accuracy and speed in 2025.

KYC Compliance Checklist for U.S. Businesses in 2025

KYC Trends in the USA for 2025

KYC is evolving rapidly. AI-driven tools are enhancing identity verification accuracy, while real-time monitoring systems flag suspicious activities instantly. Regulatory tech (RegTech) solutions are streamlining compliance, reducing manual workloads. As FinCEN notes, “Innovation in compliance technology is key to combating financial crime effectively,” emphasizing the shift toward tech-driven KYC processes.

Wrapping Up

KYC in the USA protects businesses and ensures compliance with BSA, PATRIOT Act, and CDD Rule regulations. Digital tools and proactive strategies streamline the process. Is your KYC process fully automated and compliant? Book a free demo with VOVE ID today to reduce onboarding time, cut compliance costs, and meet 2025 KYC standards with confidence!