KYC Compliance in Algeria: 2025 Guide to Identity Verification & AML

Discover KYC requirements in Algeria for 2025, including AML compliance, identity verification challenges, and how VOVE ID streamlines secure onboarding in North Africa.

Picture a digital bank in Oran onboarding a new customer for a mobile banking app. The signup looks promising, but before moving forward, they must verify the customer’s identity to comply with Algeria’s anti-money laundering laws. This is where Know Your Customer (KYC) compliance comes in—ensuring individuals are who they claim to be to prevent fraud, money laundering, and terrorist financing. In Algeria, KYC is driven by local regulations, global Financial Action Task Force (FATF) standards, and challenges like a cash-based informal economy. This guide explains KYC requirements in Algeria and how VOVE ID streamlines identity verification in North Africa.

Regulatory Framework for KYC in Algeria

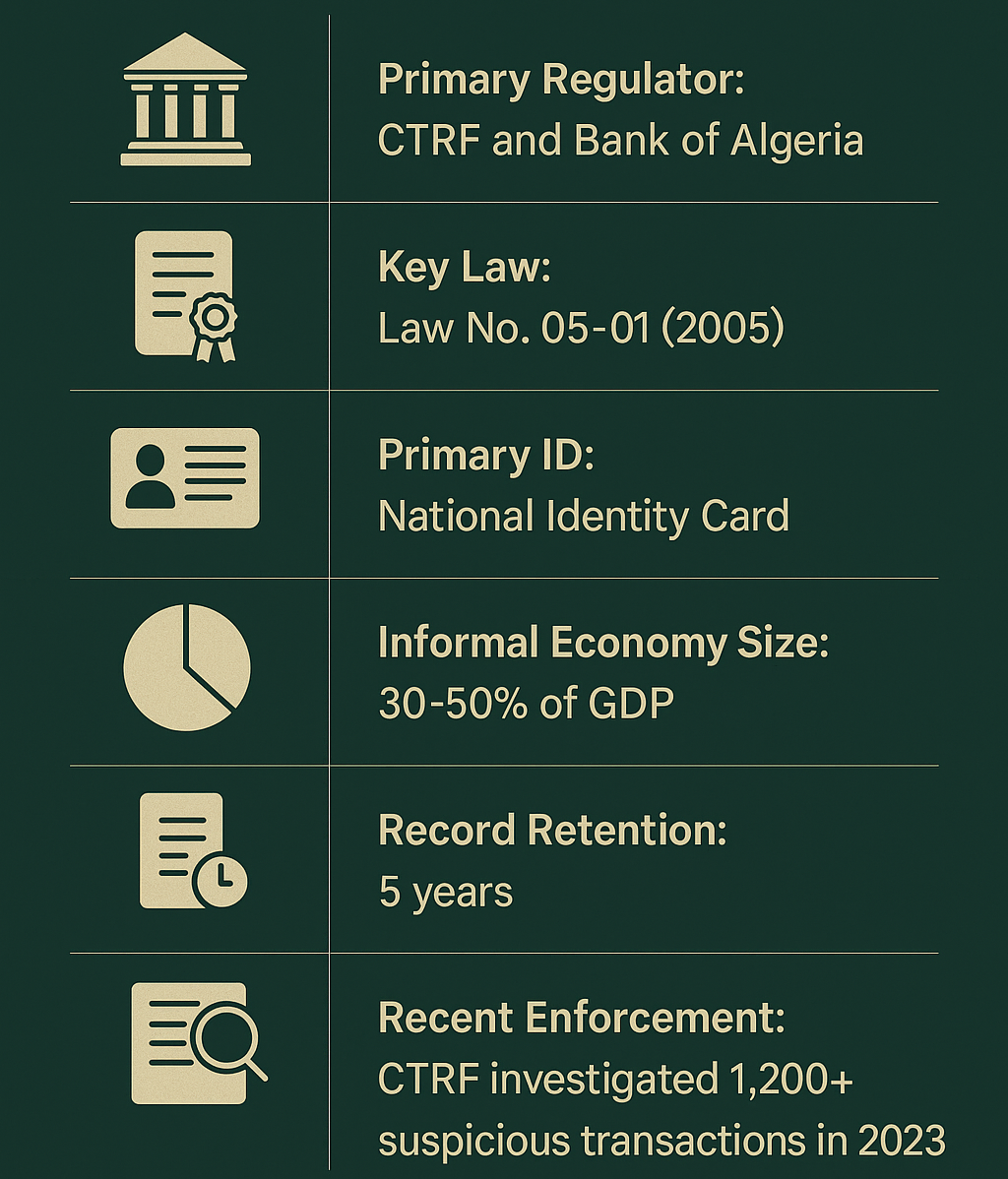

Algeria has strengthened its AML and Counter-Terrorist Financing (CFT) framework, earning FATF recognition in 2016 for addressing key deficiencies. The 2023 Mutual Evaluation Report by the Middle East and North Africa FATF (MENAFATF) rated Algeria Compliant on 2 and Largely Compliant on 14 of FATF’s 40 Recommendations. Key regulations shaping KYC compliance include:

- Law No. 05-01 (2005): Mandates customer due diligence to combat money laundering and terrorist financing.

- Bank of Algeria: Enforces KYC and AML standards for financial institutions.

- Cellule de Traitement du Renseignement Financier (CTRF): Monitors suspicious transactions, investigating over 1,200 reports in 2023.

In October 2024, Algerian authorities signaled plans to modernize digital identity verification systems, aiming to align with evolving FATF and MENAFATF expectations.

KYC Requirements in Algeria

KYC compliance in Algeria involves verifying customer identities and assessing risks. Key requirements include:

- Customer Identification:

- Collect and verify identity documents such as the National Identity Card (Carte Nationale d’Identité Biométrique) or passport.

- Verify address using utility bills or residency certificates.

- Customer Due Diligence (CDD):

- Screen customers against sanctions lists (e.g., UN, EU) and Politically Exposed Persons (PEPs) databases.

- Assess risk based on transaction patterns, source of funds, or geographic location.

- Enhanced Due Diligence (EDD):

- Apply stricter checks for high-risk customers, such as PEPs or those linked to high-risk jurisdictions.

- Record-Keeping:

- Retain KYC records for five years, accessible to the CTRF upon request.

The National Identity Card, issued by the Ministry of Interior, is the primary ID for KYC, often verified via biometric data. Manual verification can be slow, making digital solutions like VOVE ID critical.

Challenges in Algerian KYC Compliance

KYC compliance in Algeria faces distinct obstacles:

- Informal Economy: With 30-50% of GDP tied to cash-based transactions, verifying identities is challenging.

- Digital Infrastructure Gaps: Limited access to digital ID systems in rural areas slows e-KYC adoption.

- Fraud Risks: Rising identity fraud requires robust biometric and liveness checks.

Algeria KYC Quick Facts

Best Practices for KYC in Algeria

To excel in AML compliance in Algeria:

- Leverage e-KYC: Use digital tools like VOVE ID for real-time ID verification and biometric checks, which can reduce verification times by up to 70% compared to manual processes.

- Integrate Local Data: Connect to Algerian ID databases for accurate verification.

- Monitor Continuously: Screen transactions and update KYC data regularly.

- Train Staff: Ensure teams understand local AML laws and FATF guidelines.

How VOVE ID Simplifies KYC in Algeria

KYC compliance in Algeria can be seamless with VOVE ID, a solution tailored for identity verification in North Africa. Key features include:

- Biometric Verification: Validates National Identity Cards and passports with facial recognition and liveness checks.

- Real-Time Screening: Screens against global sanctions, PEP lists, and 1,700+ watchlists for AML compliance.

- Fast Onboarding: Reduces verification time from days to seconds, overcoming bureaucratic delays.

- Tailored for Algeria: Addresses informal economy challenges and limited digital infrastructure.

- FATF & MENAFATF Alignment: Ensures compliance with FATF and MENAFATF standards through automated due diligence and risk assessments.

Whether you're a fintech based in Algeria or a global bank onboarding Algerian customers, VOVE ID ensures seamless, secure compliance. With real-time screening, biometric ID checks, and alignment with FATF standards, VOVE ID empowers businesses across North Africa to build trust and meet KYC, AML, and identity verification requirements in 2025 and beyond. Have questions? Reach out to us via VOVE ID's contact page.