KYC Compliance in Angola: 2025 Guide for Regulated Businesses

Learn how to meet KYC and AML compliance in Angola. Explore local laws, digital ID trends, and how eKYC solutions like VOVE ID support secure onboarding.

Introduction

As Angola modernizes its financial sector and opens further to foreign direct investment, Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance have become strategic priorities. Regulatory reform, international cooperation, and digital identity verification are changing how regulated entities approach customer onboarding and risk assessment.

This 2025 guide provides a clear overview of KYC requirements in Angola, the evolving regulatory framework, and how eKYC solutions like VOVE ID are enabling secure, remote identity verification across Africa.

Angola’s KYC and AML Regulatory Framework

Key Regulatory Authorities

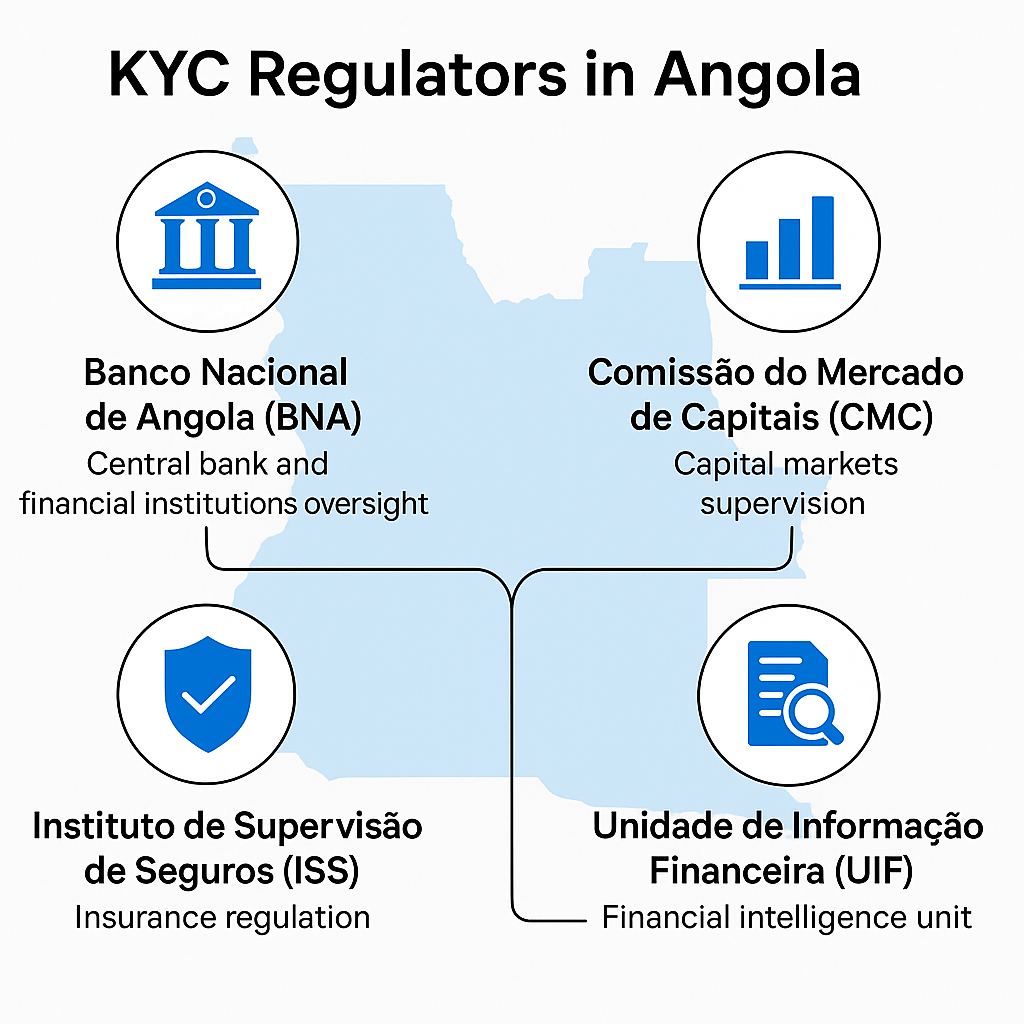

Angola's KYC regulations are enforced through a network of institutions:

- Banco Nacional de Angola (BNA) – The central bank issues operational directives and supervises AML compliance for financial institutions. Notably, Directives 01/2025 and 02/2025 establish updated guidelines for risk-based customer due diligence and enhanced monitoring.

- Comissão do Mercado de Capitais (CMC) – Regulates capital markets and oversees AML/CFT in securities.

- Instituto de Supervisão de Seguros (ISS) – Monitors the insurance sector.

- Unidade de Informação Financeira (UIF) – Angola’s Financial Intelligence Unit responsible for handling Suspicious Transaction Reports (STRs).

Legal Foundations

Angola’s legal framework for KYC and AML compliance includes:

- Law No. 34/11 – Sets core obligations for KYC, recordkeeping, and suspicious activity reporting.

- Law No. 3/14 – Expands the list of predicate offenses and introduces stronger enforcement tools.

- BNA Directives 01/2025 and 02/2025 – Define new standards for onboarding, enhanced due diligence (EDD), and internal AML controls.

These regulations align with FATF Recommendations, supporting Angola’s broader effort to improve transparency and tackle illicit finance.

KYC in Practice: Compliance Requirements

All regulated businesses—including banks, fintech companies, insurance firms, and telecom providers—must implement a comprehensive Customer Due Diligence (CDD) program. Key obligations include:

- Verifying identity documents (BI national ID, passports, driver’s licenses),

- Collecting and verifying beneficial ownership data for legal entities,

- Ongoing transaction monitoring for anomalies,

- Reporting suspicious transactions to the UIF.

Enhanced Due Diligence (EDD)

Enhanced due diligence is required when onboarding:

- Politically Exposed Persons (PEPs),

- High-risk customers or geographies,

- Complex structures with unclear purpose.

EDD includes deeper verification of identity, source of funds, and close monitoring.

| Feature | CDD (Standard) | EDD (Enhanced) |

|---|---|---|

| Required For | Most customers | PEPs, high-risk clients |

| ID Verification Level | Basic ID check | Biometric + source of funds |

| Ongoing Monitoring | Periodic | Real-time / frequent |

| Reporting | Standard STR | Immediate alerting |

The Role of eKYC and Digital Identity in Angola

With only 29% of adults holding a bank account (World Bank, 2023), and a large portion of the economy operating informally, traditional onboarding in Angola is costly and inefficient.

This has led to increased interest in eKYC Angola solutions—tools that allow remote identity verification using digital technology.

Benefits of Digital KYC

Adopting digital identity verification brings:

- Faster, remote customer onboarding,

- Biometric checks to prevent identity fraud,

- OCR and AI-driven ID document validation,

- Better scalability across urban and rural segments.

Digital KYC not only boosts AML compliance in Angola, but also supports financial inclusion and customer trust.

VOVE ID: Built for African Compliance

VOVE ID delivers a purpose-built KYC solution for Africa’s regulatory landscape. With biometric identity checks, real-time document authentication, and seamless API integration, VOVE ID enables businesses in Angola to:

- Onboard users remotely and securely,

- Comply with evolving KYC/AML regulations,

- Serve both formal and informal market segments.

Whether you’re a fintech, bank, or telecom provider, VOVE ID supports efficient, compliant expansion across Angola and beyond.

Data Privacy and Security

While Angola has no standalone data protection law, its Constitution (Article 32) protects personal privacy. Regulatory guidance from the BNA emphasizes:

- Secure storage and access control for identity data,

- Clear retention policies,

- Obtaining customer consent for processing and sharing.

These principles are essential for compliant digital identity verification in Africa.

Challenges in KYC Implementation

Despite progress, businesses face serious implementation challenges:

- Limited regulatory capacity in rural areas,

- Corruption risks in both public and private sectors,

- Low digital infrastructure and literacy in underserved communities,

- High dependency on cash transactions, complicating transaction monitoring.

These realities call for scalable eKYC systems tailored to Angola’s specific constraints.

International Cooperation

Angola is a member of the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) and has been working toward FATF compliance.

- The country currently meets or partially meets 22 of 40 FATF Recommendations.

- IMF-supported reforms and technical partnerships aim to improve enforcement and risk supervision effectiveness.

These efforts underscore Angola’s commitment to aligning its AML compliance framework with global standards.

A national biometric ID initiative launched in 2023 is set to streamline citizen authentication and facilitate access to banking services.

Angola’s economic diversification push includes digital transformation in the financial sector, aligning with KYC modernization goals.

Conclusion

Angola’s regulatory landscape is becoming more robust, but practical KYC implementation remains a challenge—especially in reaching unbanked and rural populations.

By leveraging eKYC solutions like VOVE ID, regulated businesses can reduce onboarding friction, enhance compliance, and unlock growth across the region.

👉 Book a free demo with VOVE ID to see how our platform can help you meet KYC and AML requirements in Angola—securely, efficiently, and at scale.