KYC Compliance in Saudi Arabia: 2025 Guide to Regulations, Process & Best Practices

Master KYC compliance in Saudi Arabia with our 2025 guide. Explore regulations, identity verification processes, and VOVE ID’s e-KYC solutions to prevent financial crime.

Introduction

As Saudi Arabia accelerates its Vision 2030 goals, Know Your Customer (KYC) compliance is more critical than ever. With a booming digital economy and evolving Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations, businesses must verify customer identities accurately to stay ahead of regulatory shifts. KYC not only protects against financial crimes like money laundering but also supports the Kingdom’s ambition to become a global financial hub. This guide explores Saudi KYC regulations for 2025, the verification process, and practical steps for businesses to ensure compliance.

What is KYC?

KYC is the process businesses use to confirm their customers’ identities and understand their financial activities. It fosters trust, prevents illicit activities at their earliest stages, and ensures adherence to regulatory standards. By collecting and verifying customer information, assessing risk, and monitoring transactions, KYC strengthens Saudi Arabia’s financial system. KYC compliance is mandatory for regulated sectors, ensuring regulatory integrity across industries.

Who Needs to Comply with KYC in Saudi Arabia?

KYC compliance applies to a broad range of entities in Saudi Arabia to safeguard the financial system. The table below summarizes key sectors required to implement KYC:

| Sector | KYC Requirements |

|---|---|

| Banks and Financial Institutions | Verify customer identities for banks, fintechs, insurance, and money exchangers. |

| DNFBPs | Real estate, law firms, accounting, and precious metals dealers must conduct KYC. |

| VASPs | Cryptocurrency exchanges and digital asset platforms require strict KYC checks. |

| High-Value Sectors | E-commerce and trading businesses often adopt KYC to mitigate risk, though not mandatory. |

Non-compliance can lead to severe penalties, including fines up to SAR 7 million or imprisonment for up to seven years, as stipulated in Article 23 of the Anti-Money Laundering Law (Royal Decree No. M/20 of 2017).

Legal Framework for KYC in Saudi Arabia

To combat financial crime, Saudi Arabia has established a robust legal framework for KYC compliance, aligned with Financial Action Task Force (FATF) standards, of which the Kingdom has been a member since 2019. Key regulations include:

- Anti-Money Laundering Law (Royal Decree No. M/20 of 2017): Mandates KYC procedures, customer due diligence (CDD), and suspicious transaction reporting to the Saudi Arabian Financial Investigation Unit (SAFIU). Amended in 2019, it strengthens ultimate beneficial owner (UBO) transparency and e-KYC adoption in line with FATF recommendations.

- SAMA KYC Requirements: Requires financial institutions to verify identities, assess risks, and appoint a Money Laundering Reporting Officer (MLRO). Customer profiles must be updated every five years.

- Ministry of Commerce AML/CFT Manual: Guides DNFBPs on implementing KYC to meet AML/CFT standards.

- FATF Recommendations: Saudi Arabia is compliant with 19 and largely compliant with 17 of the 40 FATF recommendations, per the 2020 Mutual Evaluation Report.

Compared to the UAE, Saudi Arabia’s KYC framework is similarly rigorous but emphasizes digital adoption more heavily, with SAMA’s sandbox fostering e-KYC innovation faster than the UAE’s National KYC Platform. These regulations, overseen by the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA), reinforce Saudi Arabia’s global financial reputation.

KYC Verification Process in Saudi Arabia

The KYC process in Saudi Arabia is thorough and efficient, enabling businesses to verify identities seamlessly. Key steps include:

- Customer Identification:

- Collect details like full name, date of birth, nationality, and occupation.

- Require documents such as National ID, passport, or utility bills (not older than three months).

- Document Verification:

- Authenticate documents via government registries or e-KYC solutions.

- Verify National IDs issued by the Ministry of Interior’s Agency of Civil Affairs.

- Risk Assessment:

- Evaluate risk based on customer profiles, financial activities, or links to high-risk jurisdictions.

- Apply enhanced due diligence (EDD) for high-risk clients, such as politically exposed persons (PEPs).

- Ongoing Monitoring:

- Track transactions for unusual patterns, like large cash transfers.

- Update customer records regularly to comply with Saudi KYC regulations 2025.

- Record Keeping:

- Maintain records for at least five years, including KYC data and audit trails, for regulatory inspections.

e-KYC solutions, supported by SAMA’s initiative to license digital-only banks (first introduced in 2020), leverage AI and real-time data to streamline identity verification in Saudi Arabia.

Recent Developments in KYC Compliance

Saudi Arabia is advancing KYC compliance to align with Vision 2030’s goal of a diversified, digital-first economy. SAMA’s “Always Open” Regulatory Sandbox, updated in 2022, encourages fintechs to test e-KYC solutions, contributing to a 37% year-on-year fintech growth in 2021. Recent posts on X (May 2025) from Saudi financial accounts emphasize updating National ID details to avoid account freezes, underscoring the focus on accurate KYC data. A case study from Aseel, which reduced onboarding time by 87% using e-KYC, highlights the transformative impact of digital solutions.

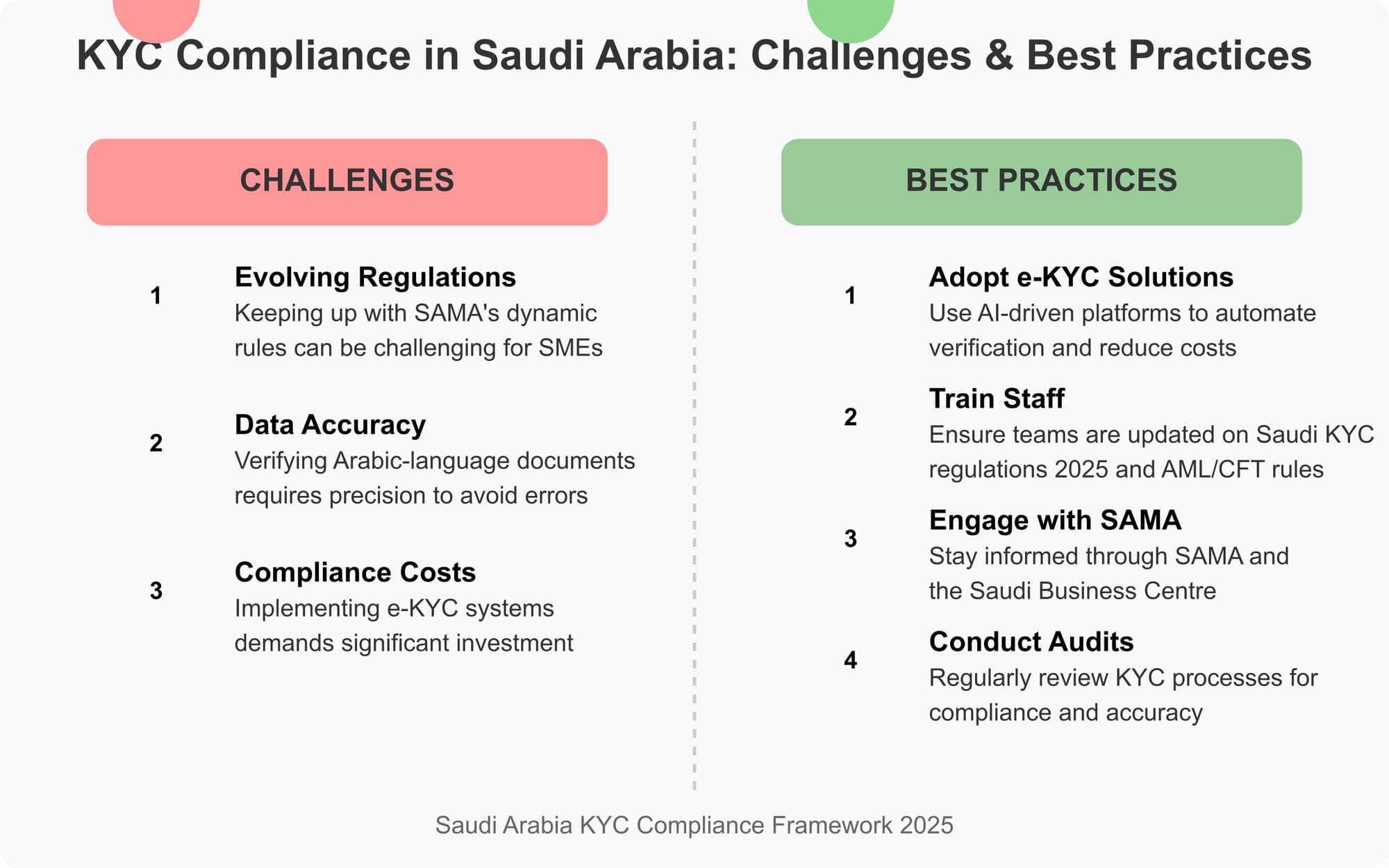

Challenges and Best Practices

Businesses face challenges in KYC compliance, including:

- Evolving Regulations: Keeping up with SAMA’s dynamic rules can be challenging for SMEs.

- Data Accuracy: Verifying Arabic-language documents requires precision to avoid errors.

- Compliance Costs: Implementing e-KYC systems demands investment.

Best practices include:

- Adopt e-KYC Solutions: Use AI-driven platforms to automate verification and reduce costs.

- Train Staff: Ensure teams are updated on Saudi KYC regulations 2025 and AML/CFT rules.

- Engage with SAMA: Stay informed through SAMA and the Saudi Business Centre.

- Conduct Audits: Regularly review KYC processes for compliance and accuracy.

How VOVE ID Can Help

VOVE ID simplifies KYC compliance in Saudi Arabia with AI-powered e-KYC solutions tailored to SAMA and FATF standards. Our platform automates identity verification, risk assessment, and monitoring, helping banks, fintechs, and DNFBPs stay compliant efficiently. Learn more at VOVE ID.

Conclusion

KYC is vital for Saudi Arabia’s secure and innovative financial system, aligning with Vision 2030’s ambition to process 70% of payments digitally by 2030, as reported by SAMA. By embracing automation, staying aligned with SAMA’s updates, and choosing the right compliance partner, businesses can navigate KYC obligations smoothly and sustainably in 2025 and beyond.

Frequently Asked Questions

Is KYC mandatory in Saudi Arabia for all businesses?

No, it is mandatory only for regulated sectors such as financial institutions, DNFBPs, VASPs, and businesses in high-risk industries.

What is the role of the National ID in KYC?

The National ID, issued by the Ministry of Interior, serves as a primary identity document for KYC verification.

What are the penalties for non-compliance?

Fines up to SAR 7 million, imprisonment for up to seven years, and reputational damage.