KYC Compliance in Tanzania: 2025 Overview

Discover KYC regulations in Tanzania for 2025, including AMLA, BoT, and NIDA eKYC integration. Ensure regulatory compliance with VOVE ID.

Regulatory Framework: Who Oversees KYC in Tanzania?

Tanzania’s Know Your Customer (KYC) landscape is governed by a robust legal framework aimed at combating money laundering, terrorist financing, and ensuring compliance with data protection regulations.

- Anti-Money Laundering Act, Cap. 423 (Revised Edition 2022, amended through 2025): This act forms the foundation of Tanzania’s AML/CFT regime, mandating Customer Due Diligence (CDD), record-keeping, and suspicious transaction reporting.

- Financial Intelligence Unit (FIU): Under the Ministry of Finance and Planning, the FIU receives, analyzes, and disseminates financial intelligence related to money laundering and terrorist financing.

- Bank of Tanzania (BoT): The central bank issues AML guidelines and supervises compliance for banks, financial institutions, and payment service providers.

- Personal Data Protection Act, 2022: In effect since 1 May 2023, this act governs the collection, processing, and storage of personal data, requiring explicit customer consent and secure handling of KYC data.

KYC Requirements in Practice

For Individuals

Financial institutions must collect and verify the following information:

- Full Name (as per official ID)

- Date and Place of Birth

- Residential Address

- Official Identification: The National ID from NIDA is the primary document. Voter cards may be accepted as secondary ID with additional checks.

- Occupation and Source of Income

For Legal Entities

Companies and partnerships must provide:

- Certificate of Incorporation or Registration

- Memorandum and Articles of Association

- Physical and Postal Address

- Taxpayer Identification Number (TIN)

- Details of Directors and Beneficial Owners

- Board Resolution Authorizing Account Opening

Enhanced Due Diligence (EDD)

For high-risk clients, such as PEPs or cross-border customers, institutions must:

- Obtain senior management approval

- Verify source of funds and wealth

- Monitor the relationship continuously

📑Example: A politically exposed person (PEP) running a cross-border NGO would require approval, deep verification of funding sources, and regular monitoring.

Record-Keeping Obligations

Under Section 17 of the AML Act, KYC and transaction records must be kept for at least 10 years after the end of the business relationship.

Penalties for Non-Compliance

Failure to comply with KYC and AML requirements in Tanzania may result in:

- Monetary Penalties: BoT and FIU can impose substantial fines for breaches in customer verification and record-keeping.

- License Suspension or Revocation: Repeated non-compliance may lead to revocation of operational licenses.

- Reputational Damage: Financial institutions may face public disclosure and reputational risk, especially in cross-border operations.

Digital KYC: Enabling Secure and Scalable Onboarding

Tanzania’s digital transformation is reshaping KYC procedures through mobile technology, biometric verification, and API integrations.

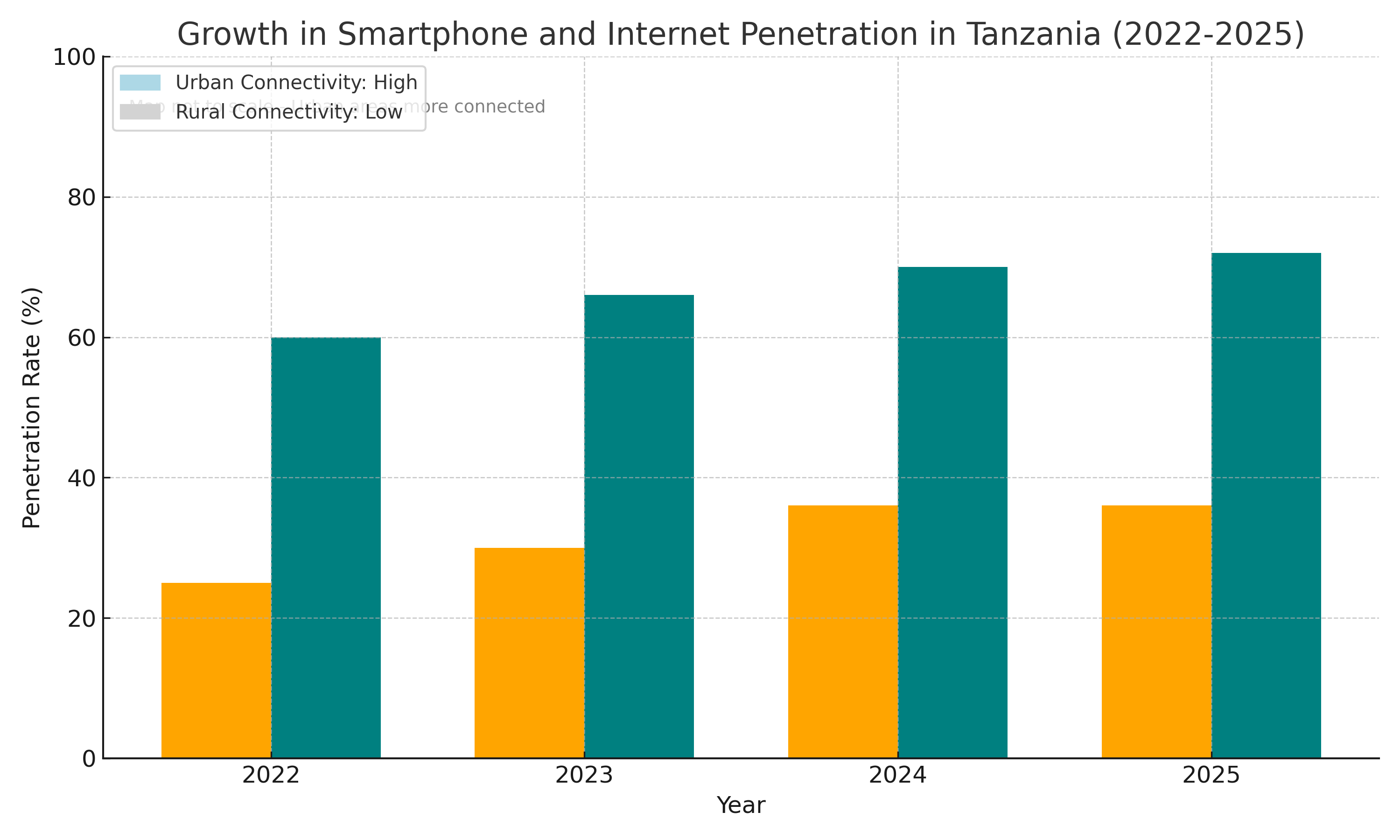

Mobile and Internet Penetration

As of December 2024, smartphone penetration reached 36%, up from 25% in 2022. Internet access stood at 72% by March 2025, largely driven by mobile networks and shared device usage.

Biometric ID Verification and API Integrations

The National Identification Authority (NIDA) maintains a centralized biometric ID database. Financial institutions increasingly integrate with NIDA’s APIs to verify identities in real-time, enhancing both compliance and user experience.

AI-Powered Risk Assessment

Modern eKYC platforms use artificial intelligence to dynamically assess risk, detect fraud, and trigger EDD procedures when needed.

VOVE ID, a leading eKYC platform, leverages NIDA integration and AI-driven risk scoring to enable secure onboarding while meeting BoT, FIU, and PDPA compliance standards.

Challenges in KYC Implementation

Despite progress, institutions face key challenges:

- Fragmented Identity Systems: Multiple ID types (e.g., NIDA ID, voter card, driver’s license) complicate manual verification. VOVE ID addresses this via a unified platform compatible with major Tanzanian ID formats.

- Limited Rural Connectivity: While cities benefit from digital infrastructure, rural areas lag behind, slowing eKYC adoption.

- Cost Constraints: For small fintechs, deploying compliant KYC systems remains expensive.

- Evolving Regulations: Institutions must stay updated with BoT, FIU, and international standards such as FATF.

Regional Comparison: How Tanzania Stacks Up

Compared to its East African neighbors:

- Kenya leads in eKYC adoption, with a more developed fintech ecosystem and deeper mobile penetration.

- Uganda has recently updated its AML regulations but lacks comprehensive digital ID integration like NIDA.

- Rwanda is gaining attention for its centralized ID infrastructure and government-driven digitalization efforts.

Tanzania stands out with its comprehensive legal framework and growing digital infrastructure, but ongoing investment is needed to match regional leaders in real-time onboarding efficiency and fintech scalability.

The Role of VOVE ID in Enhancing KYC Compliance

VOVE ID supports regulated businesses in Tanzania with real-time eKYC services. Through NIDA integration, AI-powered risk scoring, and compliance with data protection laws, the platform ensures:

- Secure storage of personal data

- Explicit user consent mechanisms

- Scalable and efficient onboarding for financial institutions and fintechs

Tanzania leads Africa in mobile money usage — over 70% of adults use platforms like M-Pesa as of 2024. Yet 30% remain unbanked. VOVE ID’s compliant eKYC tools can help onboard these underbanked users into formal financial systems.

Final Thoughts

As Tanzania builds its digital financial infrastructure, KYC compliance becomes a driver of inclusion and growth. Digital platforms like VOVE ID play a pivotal role by combining regulatory adherence with technological innovation. Book a free demo with VOVE ID to see how our platform can help you meet KYC and AML requirements.