KYC vs KYB vs AML: The Complete Comparison

Learn the difference between KYC, KYB, and AML, and how these three pillars of compliance work together to protect fintechs and digital businesses in Africa and MENA in 2025.

In fintech, crypto, and digital banking, compliance is the foundation of trust. Terms like KYC, KYB, and AML are often used interchangeably, yet each covers a different part of the compliance puzzle. Understanding how they connect helps businesses stay secure and compliant across Africa and the Middle East, where regulatory frameworks are evolving rapidly.

Solutions like VOVE ID enable fintechs and digital platforms to streamline KYC, KYB, and AML processes, making compliance faster, more accurate, and easier to scale. Financial institutions, startups, and crypto exchanges must balance regulatory compliance, risk management, and user experience. Failing in any of these areas can lead to fines, reputational damage, or license suspension, depending on the regulator. For example, the CBN suspended four fintechs in 2024 for non-compliance.

What is KYC (Know Your Customer)?

KYC, or Know Your Customer, is the process of verifying the identity of individual customers before allowing them access to financial services. This foundational process reduces fraud, identity theft, and money laundering risks, while ensuring regulatory compliance.

Key steps in KYC include:

- Customer identification: Collecting ID documents, selfies, or biometric data.

- Verification: Cross-checking information against trusted databases or government registries.

- Due diligence: Assessing risk based on customer background, transaction history, and geography.

Modern eKYC platforms enable automated, API-driven verification, incorporating biometric checks, AI-driven document validation, and real-time sanctions screening. This digital approach is particularly important in markets with low ID penetration or high mobile adoption, such as Kenya, Tanzania, and Nigeria.

What is KYB (Know Your Business)?

While KYC focuses on individuals, KYB (Know Your Business) verifies corporate clients. It ensures that a company is legally registered, its ownership structure is transparent, and its ultimate beneficial owners (UBOs) are known.

Typical KYB procedures include:

- Validating company registration documents (incorporation certificates, tax IDs).

- Screening directors, shareholders, and UBOs against sanctions and politically exposed persons (PEP) lists.

- Checking corporate structure, cross-border exposure, and jurisdictional risk.

KYB reduces shell company risk by 85%, helping financial institutions avoid fraudulent entities. For fintech startups, a robust KYB process also streamlines partnerships with merchants, suppliers, or institutional clients.

What is AML (Anti-Money Laundering)?

AML, or Anti-Money Laundering, is the comprehensive framework of laws, regulations, and internal controls designed to detect and prevent financial crimes, including money laundering, terrorist financing, and fraud.

While KYC and KYB focus on verifying identities, AML encompasses:

- Transaction monitoring: Detecting suspicious or unusual activity.

- Ongoing due diligence: Continuously reviewing high-risk accounts and transactions.

- Reporting obligations: Submitting suspicious transaction reports to local Financial Intelligence Units (FIUs), such as FIC (Ghana), FIU (Tanzania), or EMLCU (Egypt).

AML standards are guided globally by the Financial Action Task Force (FATF) and implemented regionally via ESAAMLG (Eastern & Southern Africa) and MENAFATF (Middle East & North Africa).

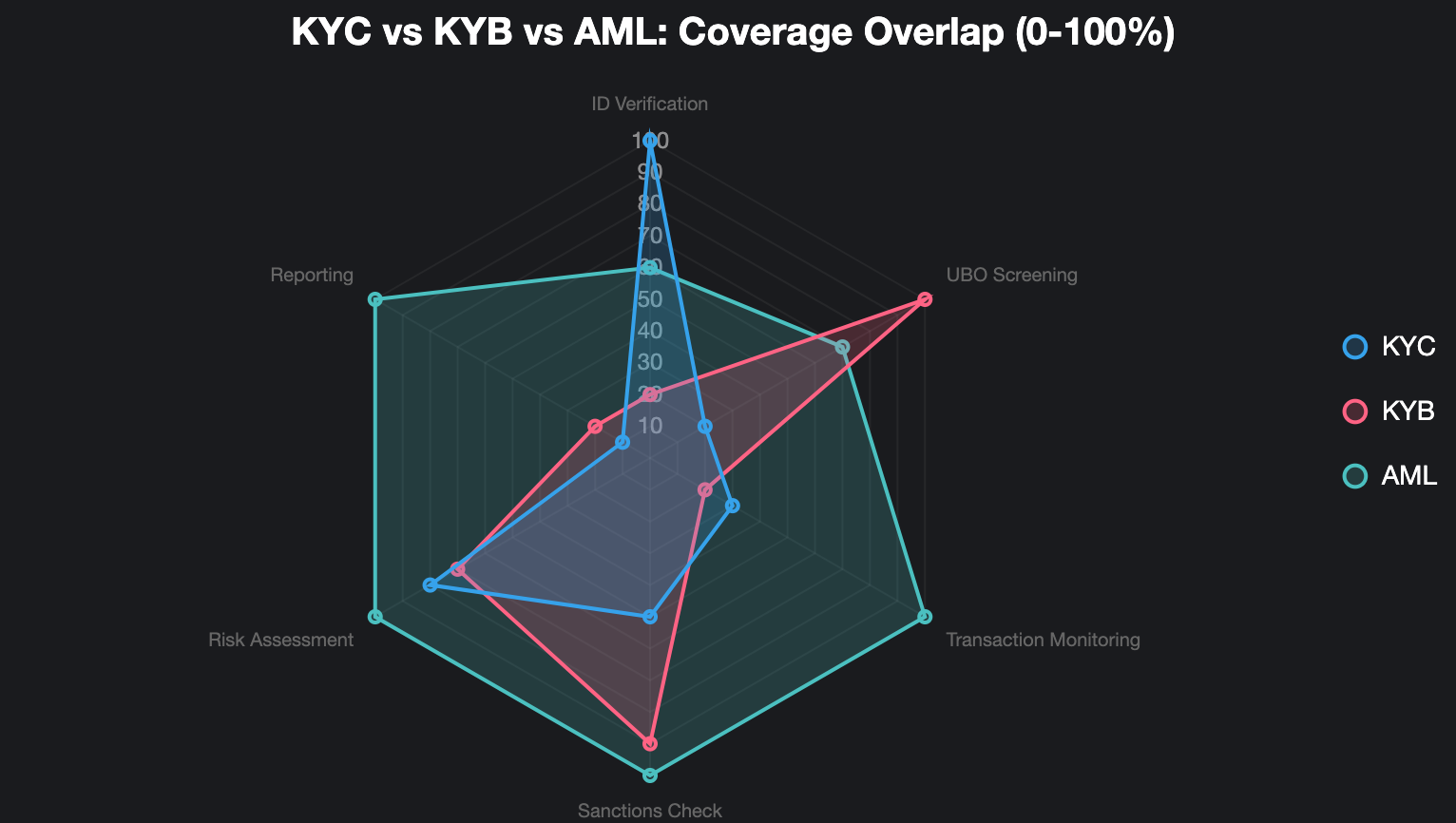

KYC vs KYB vs AML: How They Work Together

Although distinct, KYC, KYB, and AML are deeply interconnected. Together, they form a complete compliance ecosystem:

| Aspect | KYC | KYB | AML |

|---|---|---|---|

| Focus | Individuals | Legal entities | Financial crimes |

| Goal | Verify customer identity | Verify business legitimacy | Detect & prevent money laundering |

| Key Actions | ID & biometric verification | UBO & company screening | Risk monitoring & suspicious activity reporting |

| Regulatory Basis | FATF Rec.10 (CDD) | FATF Rec.24 (UBO Transparency) | FATF Rec.1–40 |

Why It Matters for Fintechs and Startups

Compliance is strategic for fintechs and startups in Africa and MENA:

- Strong KYC/KYB processes reduce onboarding friction, improve conversion, and build trust with regulators.

- Effective AML programs safeguard against fraud, financial crime, and reputational damage.

- Automated RegTech solutions allow lean teams to scale compliance without significant headcount increases.

Regional considerations:

- In Nigeria, fintechs must comply with CBN Circular 2024 and AML/KYC regulations; non-compliance can result in fines or license suspension.

- In the UAE and Saudi Arabia, regulators (DFSA, CBUAE, SAMA) require full KYB validation for corporate accounts.

- Ghanaian fintechs follow the FIC Act 2017, with a 24-hour SAR reporting deadline.

- Egypt’s EMLCU Guidelines dictate AML reporting standards and eKYC best practices.

- Regional FATF bodies like ESAAMLG and MENAFATF harmonize compliance expectations across borders.

How VOVE ID Simplifies KYC, KYB, and AML Compliance

VOVE ID helps fintechs, banks, and digital platforms streamline identity and business verification across Africa and MENA. Key features include:

- KYC: Real-time biometric and document verification.

- KYB: Company registry checks and UBO validation.

- AML Screening: Automated watchlist and sanctions monitoring.

Ready to streamline compliance? Sign up on VOVE ID and explore how fast, API-first KYC and KYB can transform your onboarding. Start verifying in minutes: no manual checks, no friction.

Conclusion

KYC verifies who your customers are.

KYB confirms that businesses are legitimate and transparent.

AML ensures transactions are monitored for financial crime.

Together, they form a unified shield for responsible innovation in fintech and digital finance.

With advanced solutions like VOVE ID, achieving regulatory compliance no longer requires sacrificing speed, efficiency, or user experience.