Navigating KYB Compliance in Saudi Arabia: A 2025 Guide with VOVE ID

Learn how businesses in Saudi Arabia can meet 2025 KYB compliance requirements, including UBO disclosure rules, AML regulations, and digital verification tools tailored to the Kingdom's regulatory landscape.

Introduction

As Saudi Arabia accelerates its Vision 2030 agenda, the government has introduced enhanced measures to promote transparency and prevent financial crimes. Central to this effort is a stronger focus on Know Your Business (KYB) compliance, particularly in verifying corporate clients, their ownership structures, and related risks. With the enforcement of Ultimate Beneficial Ownership (UBO) disclosure rules from April 3, 2025, the regulatory environment is evolving rapidly.

For companies operating in or with Saudi Arabia, aligning with these new KYB standards is essential—not only to avoid regulatory penalties, but to maintain trusted partnerships and access financial services. Technology platforms, such as VOVE ID, are increasingly being adopted by regulated entities to streamline compliance and adapt to national verification practices.

Understanding KYB in Saudi Arabia

KYB refers to the process of verifying the legitimacy of business entities during onboarding and throughout the business relationship. In Saudi Arabia, this process is informed by national laws and international anti-money laundering (AML) standards.

Key regulatory components include:

- Anti-Money Laundering Law (Royal Decree No. M/20 of 2017)

Requires businesses to apply customer due diligence (CDD), maintain adequate records, and report suspicious activities to relevant authorities. - UBO Disclosure Regulation (effective April 3, 2025)

Companies must identify and register their ultimate beneficial owners with the Ministry of Commerce. Any changes to ownership must be reported within 15 days, and a UBO register must be maintained and updated regularly. - FATF Compliance

As a member of the Financial Action Task Force (FATF), Saudi Arabia aligns its AML/CFT policies with global standards.

Failure to comply can result in substantial penalties, including fines of up to SAR 7 million and criminal liability in severe cases.

KYB Compliance Timeline in Saudi Arabia

Saudi Arabia’s approach to business verification and financial compliance has progressed over the past several years:

- 2017: Enactment of the AML Law

- 2019: Launch of the National Risk Assessment Framework

- 2023: Expansion of digital verification systems integrated with national registries

- 2025: Enforcement of mandatory UBO reporting and stricter KYB requirements

These developments reflect the country’s broader strategy to foster a trusted investment climate and meet international expectations for transparency.

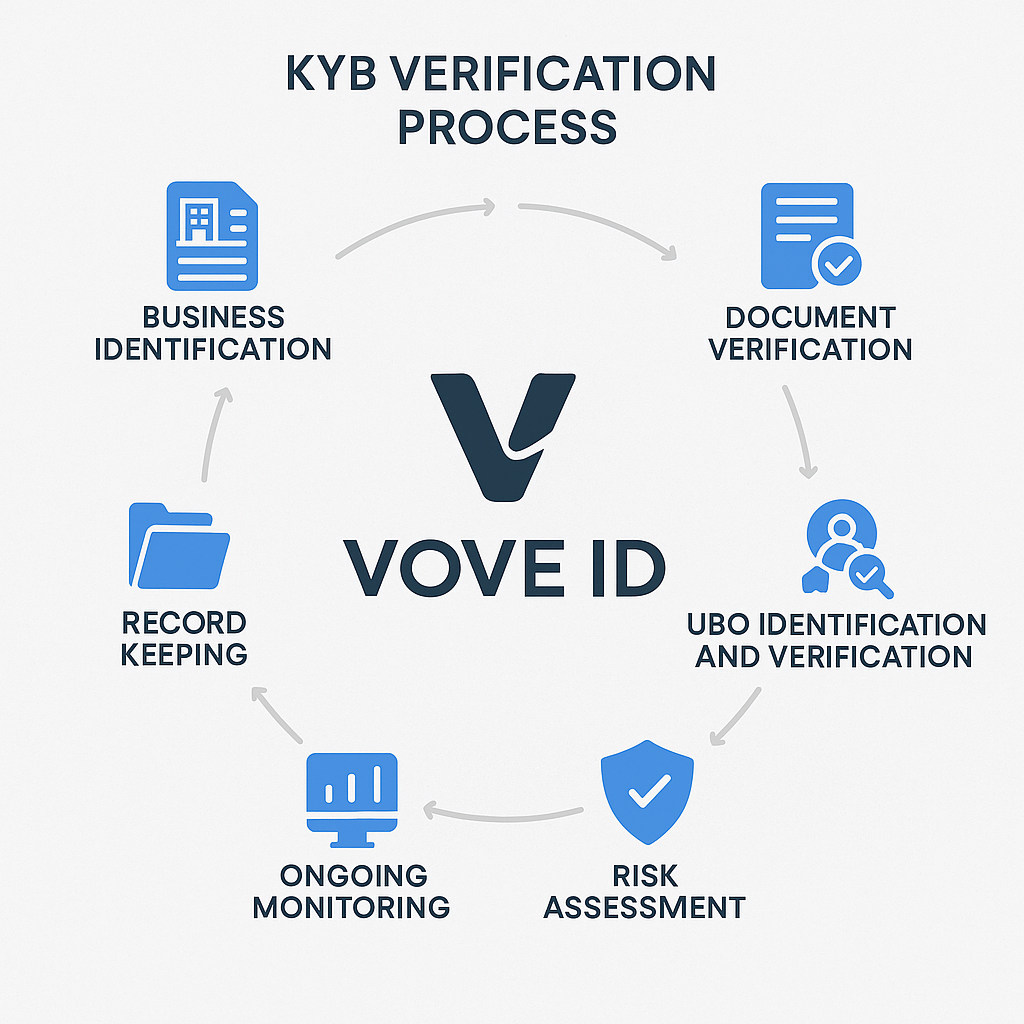

The KYB Verification Process: 6 Key Steps

To comply with Saudi regulations and international AML guidelines, businesses should follow a structured KYB process. A typical workflow includes:

- Business Identification

Gather and verify the official name, registration number, and contact details of the legal entity. - Document Verification

Confirm the authenticity of business licenses, articles of incorporation, and other registration documents via official government sources. - UBO Identification

Determine individuals who directly or indirectly control 25% or more of the business and verify their identity with supporting documentation. - Risk Assessment

Evaluate the entity’s risk level based on industry, geography, business structure, and ownership complexity. - Ongoing Monitoring

Periodically update client information, screen against sanctions lists, and flag unusual activities for review. - Record Keeping

Maintain all verification records for at least five years, in line with Saudi AML law requirements.

Sector-Specific KYB Challenges

KYB implementation can differ significantly by industry. Some of the most common challenges in Saudi Arabia include:

- Financial Services

Banks and fintechs must deal with large volumes of corporate clients, cross-border ownership, and high regulatory scrutiny. - Real Estate and Construction

Projects often involve joint ventures and foreign investment, requiring additional verification of offshore entities and funding sources. - Professional Services (Legal, Accounting)

These firms often act as intermediaries and need to balance confidentiality with disclosure obligations under AML laws. - E-commerce and Digital Platforms

Rapid onboarding processes can increase exposure to fraudulent businesses if KYB is not properly enforced.

Technology Support for KYB in Saudi Arabia

As KYB becomes more complex, organizations are turning to automated solutions to improve accuracy and reduce operational burden. Features relevant to the Saudi regulatory environment include:

- AI-Powered Document Recognition

Automatically extracts and verifies information from Arabic-language documents such as commercial licenses and registration certificates. - Integration with Government Databases

Allows for real-time validation against authoritative sources, reducing manual input and the risk of human error. - Risk Scoring and Case Management Tools

Help compliance teams classify entities by risk and track resolution of verification flags or discrepancies. - Secure Recordkeeping Systems

Ensure safe storage of verification files and audit trails, supporting regulatory inspections and internal governance.

VOVE ID: A Localized KYB Platform

VOVE ID is a compliance platform offering identity and business verification tools tailored for regulated entities in Saudi Arabia and the broader Gulf region. While its core technology supports identity verification (eKYC) and fraud prevention, the platform also supports corporate client onboarding and KYB workflows.

Key features include:

- AI-Driven Identity Verification

Automates ID checks using face match, liveness detection, and OCR, all optimized for Arabic documents. - Compliance Workflow Automation

Allows regulated entities to configure approval flows and integrate verification steps into internal systems via API. - Real-Time Government Checks

Enables lookups against Saudi national registries and official records. - Modular Integration

VOVE ID offers flexible SDKs and API tools that can be integrated into mobile apps or web-based onboarding systems.

These capabilities support businesses in maintaining compliance while improving operational efficiency across regulated sectors.

Conclusion

Saudi Arabia’s KYB landscape is evolving rapidly, driven by Vision 2030 reforms and strengthened regulatory enforcement. For businesses operating in financial services, real estate, professional advisory, and other regulated fields, staying compliant requires a proactive and well-documented verification process.

Platforms like VOVE ID, with built-in support for Arabic documentation and integration with national databases, help organizations meet Saudi KYB requirements while maintaining efficiency and minimizing risk. As UBO regulations take effect in 2025, aligning your internal compliance workflows with national standards is no longer optional—it's essential.