Ghana’s Economic Growth and KYB’s Role

Understand KYB compliance in Ghana for 2025, including regulatory requirements, AML obligations, business verification, and digital onboarding trends. Learn how fintechs and startups can meet due diligence standards effectively.

Ghana’s fintech surge, fueled by over 40 million mobile money accounts (GSMA, 2024), cements its status as West Africa’s innovation leader. With a GDP of $76 billion and $3.7 billion in FDI in 2023 (UNCTAD), Ghana attracts fintechs, BNPL startups, and digital wallets at record speed. But with opportunity comes the need for robust identity verification and business due diligence. Know Your Business (KYB) is not just a legal requirement for financial institutions, PSPs, and VAS providers — it’s essential for managing risk in Ghana’s evolving regulatory landscape. This 2025 guide breaks down Ghana fintech compliance expectations, from AML regulations to digital KYB trends, so you can confidently onboard merchants and business partners.

The Regulatory Landscape for KYB in Ghana

In Ghana, multiple authorities govern KYB and AML practices:

📌 Financial Intelligence Centre (FIC): Ghana’s AML/CFT authority, enforcing the Anti-Money Laundering Act, 2020 (Act 1044). It mandates Customer Due Diligence (CDD) and KYB, with fines up to GHS 12 million (~$800,000 USD) for breaches, per industry estimates. Visit FIC.

📌 Bank of Ghana (BoG): Oversees banks, fintechs, and payment providers, requiring beneficial owner verification per 2021 AML/CFT guidelines.

📌 Registrar-General’s Department (RGD): Manages the company registry for validating business licenses, shareholder data, and corporate status. RGD Ghana.

Why KYB Matters in Ghana

Robust KYB protects businesses and supports Ghana’s global credibility:

- Fraud Prevention: Identifies shell companies and hidden ownership structures.

- Compliance Confidence: Avoids FIC fines up to GHS 12 million (~$800,000 USD), per industry estimates.

- Customer Confidence: Ensures transparent partnerships, building trust with merchants and end-users.

- FDI-Ready: Verified businesses attract partnerships, supporting $3.7 billion in 2023 FDI (UNCTAD).

- Efficiency Gains: Automated KYB cuts onboarding time by up to 60%, per industry benchmarks.

- Market Competitiveness: Strengthens Ghanaian firms’ credibility in global markets, attracting international partners.

KYB in Action: How a BNPL Startup in Accra Streamlined Onboarding

Ghana’s AML/CFT Framework: Key KYB Requirements

Ghana was removed from the FATF grey list in June 2021 and continues strengthening its AML/CFT framework. To maintain compliance, fintechs and regulated entities must:

📌 Verify Business Identity: Pull registration data from RGD, including legal name, address, TIN, and status.

📌 Check Beneficial Owners: Disclose and verify UBOs under Companies Act, 2019 (Act 992), using RGD’s Beneficial Ownership Register.

📌 Screen Against Sanctions: Match entities and owners with UN, EU, and FIC watchlists.

📌 Apply Risk-Based Diligence: Segment merchants by risk, applying enhanced due diligence for higher-risk sectors like fintech or real estate.

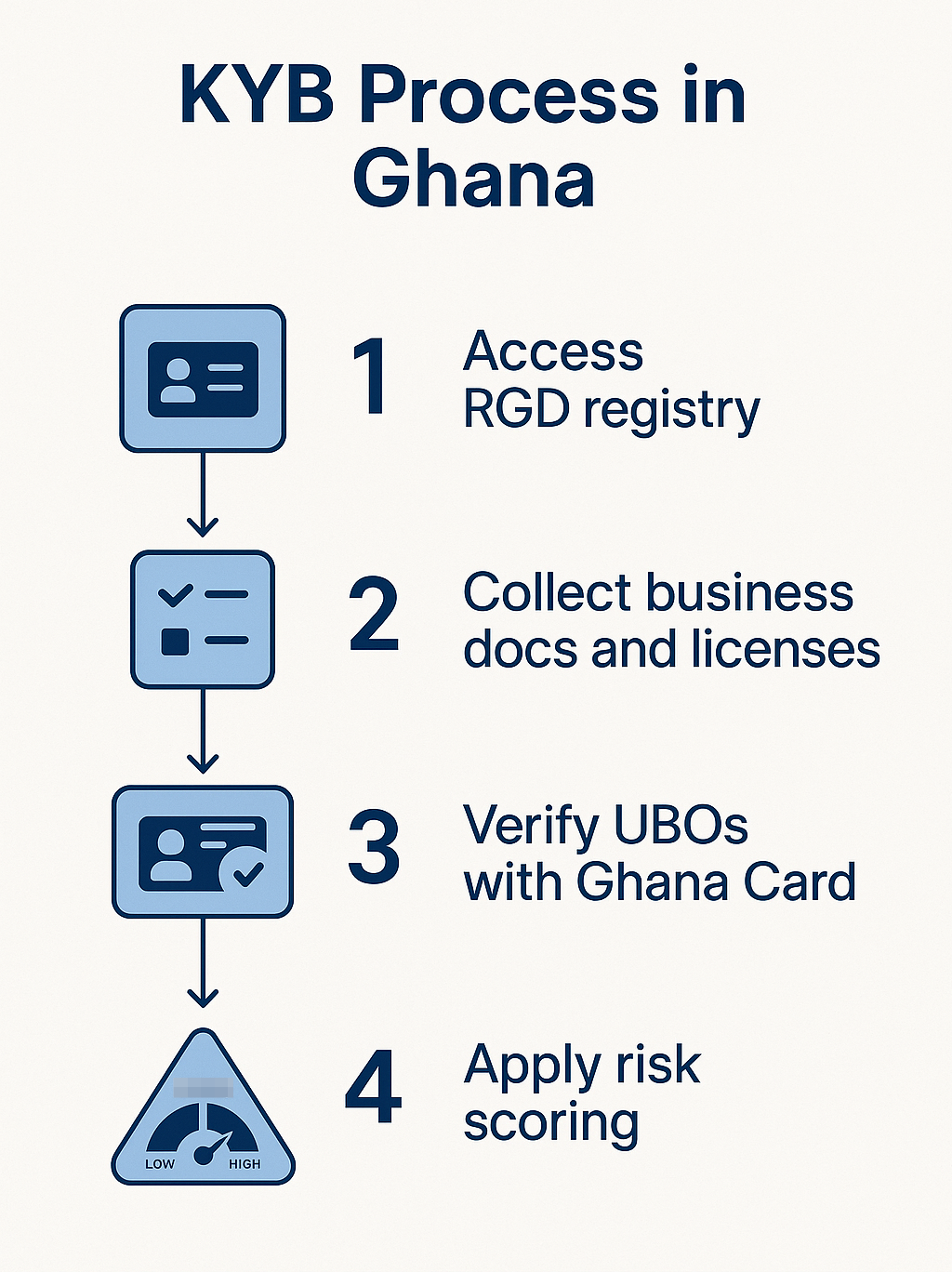

How Fintechs Perform KYB in Ghana

KYB occurs at onboarding and periodic reviews:

- Access RGD registries for verification.

- Collect incorporation documents, TINs, and licenses.

- Cross-check UBOs via Ghana Card and FIC sources.

- Apply risk scoring and maintain audit trails.

Digital Onboarding and eKYB Trends in Ghana

Ghana’s digital transformation is reshaping KYB, moving beyond manual processes. eKYB trends include:

📲 Open APIs: BoG and RGD APIs streamline verification workflows.

🆔 Ghana Card Adoption: Speeds up UBO and director verification.

📈 Mobile Money Usage: 40 million+ accounts (GSMA, 2024) drive digital onboarding.

📊 KYB in Numbers

For CMS, embed a responsive HTML table or infographic with:

- $3.7B FDI inflow in 2023 (UNCTAD)

- 40M+ mobile money accounts (GSMA, 2024)

- 60% onboarding time saved with eKYB, per industry benchmarks

- 50% fintechs using automated KYB, per Smart Africa’s 2024 Digital Identity Report

Challenges in KYB Implementation

Despite progress, Ghana’s KYB landscape faces hurdles:

🚧 Incomplete Data: Only ~60% of RGD data is digital, per industry estimates. Rural businesses often submit paper-based records, delaying KYB processes.

🚧 UBO Visibility: Ownership databases are expanding but inconsistent.

🚧 Regulatory Flux: AML reforms under FATF scrutiny may tighten KYB rules in 2025.

🚧 Low KYB Awareness Among MSMEs: Many small vendors lack understanding of KYB. For example, rural merchants often fail to provide digital records, delaying onboarding.

Ghana’s 40 million mobile money accounts (GSMA, 2024) outnumber its population, driving eKYB demand. By 2024, an estimated 50% of fintechs adopted automated KYB tools, per Smart Africa’s 2024 Digital Identity Report.

How VOVE ID Simplifies KYB in Ghana

Manual KYB is slow and error-prone. VOVE ID streamlines AML compliance in Ghana with automated business verification:

✨ Instant verification via RGD integrations

✨ Automated UBO, sanctions, and risk checks

✨ Seamless merchant onboarding with fewer manual steps

✨ Full audit logs for regulatory readiness and FATF-aligned KYB practices

Conclusion

KYB compliance is the backbone of trust in Ghana’s digital economy. Whether you’re scaling in Accra or launching in Kumasi, robust KYB is essential. Ready to streamline compliance and unlock growth? With VOVE ID, you can:

- Verify businesses faster with RGD integrations

- Stay compliant with FIC and BoG regulations

- Onboard merchants seamlessly

Contact VOVE ID for AI-powered KYB tailored to Ghana.

Want to expand to other African markets? Check out our KYB Guide for Nigeria and KYB Guide for Tanzania for cross-border compliance insights.

Frequently Asked Questions

❓ Is KYB mandatory in Ghana for all businesses?

Yes, financial and regulated entities must perform KYB for business relationships, per Act 1044.

❓ What documents are required for KYB in Ghana?

Certificate of incorporation, TIN, director/shareholder details, business license, and proof of address.

❓ Can KYB be performed digitally in Ghana?

Partially. RGD offers digital access, but full API-based onboarding is evolving. VOVE ID bridges this gap.

Ready to streamline KYB and accelerate your business growth?

Verify business partners faster and more reliably with VOVE ID — your automated business verification solution in Ghana.

✅ Fast verification through RGD integrations

✅ Compliance with FIC and Bank of Ghana regulations

✅ Smooth and seamless onboarding process

Want to see it in action?

👉 Book a free demo of VOVE ID today!

Contact us and start your journey to digital KYB transformation in Ghana.