KYB Compliance in Cameroon: 2025 Guide for Regulated Businesses

KYB compliance in Cameroon: Learn how fintechs can meet COBAC & ANIF regulations and automate business verification with VOVE ID in 2025.

For fintechs and financial institutions expanding in Central Africa, robust Know Your Business (KYB) processes are critical to ensure compliance, mitigate financial crime, and safeguard reputations. In Cameroon, KYB is a cornerstone of regulatory adherence, driven by regional and international standards. This 2025 guide outlines Cameroon’s KYB framework, key regulatory bodies, practical challenges, and how digital tools like VOVE ID streamline compliance.

Regulatory and Institutional Framework

Cameroon’s KYB and Anti-Money Laundering/Counter-Terrorism Financing (AML/CFT) framework aligns with the Central African Economic and Monetary Community (CEMAC) standards, emphasizing transparency and accountability. Key regulatory bodies include:

- Agence Nationale d’Investigation Financière (ANIF): Cameroon’s Financial Intelligence Unit, tasked with monitoring suspicious activities and enforcing AML compliance.

- Commission Bancaire de l’Afrique Centrale (COBAC): Oversees banks, fintechs, and other financial entities across CEMAC, ensuring regulatory adherence.

- Bank of Central African States (BEAC): Manages monetary policy, payment systems, and financial regulation harmonization in the region.

Key legislation, such as Law No. 2014/028 and COBAC Regulation R-2015/01, mandates KYB checks, beneficial owner identification, and meticulous record-keeping for regulated businesses.

The KYB Process in Cameroon

A comprehensive KYB process in Cameroon involves the following steps:

| Stage | Key Requirements | Purpose |

|---|---|---|

| Entity Identification | Verify business registration, incorporation documents, and registered address | Confirm the company’s legal existence |

| Ownership & UBOs | Identify beneficial owners (UBOs) with significant control or ownership | Prevent hidden ownership or shell companies |

| Authorized Representatives | Validate directors and signatories acting on behalf of the entity | Mitigate risks of impersonation or fraud |

| Operational Verification | Confirm business operations, licenses, and tax identification | Ensure legitimacy and reduce front company risks |

| Financial & Risk Assessment | Review financial data and source of funds | Detect suspicious activity or high-risk exposure |

| Screening & Monitoring | Conduct sanctions, Politically Exposed Persons (PEP), and adverse media checks | Ensure compliance and protect reputation |

Challenges in Implementing KYB in Cameroon

Despite regulatory advancements, businesses face several obstacles:

- Limited Registry Access: Partially digitized company registries slow down verification processes.

- Complex Ownership Structures: Multi-layered or family-owned entities complicate UBO identification.

- Inconsistent Enforcement: While AML laws are robust, enforcement varies across sectors.

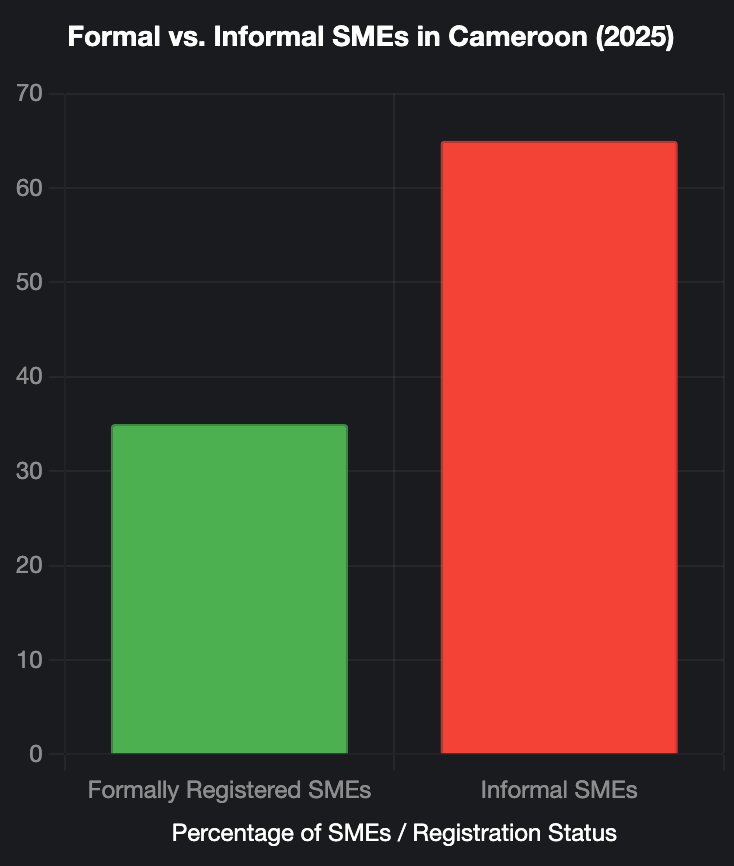

- Informal Economy: Cash-based operations and informal trade hinder traditional verification methods.

- Infrastructure Limitations: Connectivity issues and challenges in verifying document authenticity increase compliance costs.

Digital solutions like VOVE ID address these challenges by providing access to verified registries, beneficial ownership databases, and automated eKYC/KYB APIs, enabling rapid and reliable verification.

Best Practices for KYB Compliance

To navigate Cameroon’s KYB landscape effectively, businesses should adopt the following practices:

- Risk-Based Approach: Apply enhanced due diligence for high-risk sectors (e.g., mining, logistics, import-export) while streamlining checks for low-risk entities.

- Digital Verification Tools: Use platforms like VOVE ID for real-time data extraction, registry validation, and document authentication.

- Continuous Monitoring: Regularly update ownership and activity records to address changes and maintain compliance.

- Local Expertise: Collaborate with compliance professionals familiar with COBAC and ANIF regulations.

- Comprehensive Record-Keeping: Maintain detailed verification records to ensure audit readiness.

- Compliance Culture: Train teams on red flags, escalation protocols, and the importance of KYB for trust and growth.

2025 Trends Shaping KYB in Cameroon

Several trends are influencing the evolution of KYB compliance:

- Increased Transparency: Pressure from the Financial Action Task Force (FATF) and the Inter-Governmental Action Group against Money Laundering in West Africa (GABAC) is pushing for open beneficial ownership data.

- Registry Digitization: Gradual modernization of Cameroon’s business registries is improving verification efficiency.

- Fintech Growth: The proliferation of digital wallets and lending platforms is intensifying regulatory scrutiny on KYB.

- RegTech Adoption: AI-driven compliance tools and APIs are becoming industry standards.

Benefits of Robust KYB Compliance

- Fraud Prevention: Early detection of high-risk entities reduces exposure to financial crime.

- Reputation Enhancement: Transparent verification fosters trust with partners, investors, and regulators.

- Global Opportunities: Compliance with FATF standards facilitates cross-border partnerships and foreign direct investment.

Conclusion

KYB compliance in Cameroon is no longer just a regulatory requirement—it’s a strategic advantage for fintechs and financial institutions operating in Central Africa. By leveraging tools like VOVE ID, businesses can automate KYB and KYC processes, access verified data, and ensure continuous AML screening. This approach not only ensures audit readiness but also supports scalable, trustworthy growth in a dynamic regulatory environment.

Ready to simplify KYB compliance in Cameroon? With VOVE ID, you can stay fully compliant with COBAC and ANIF regulations.

Get started today and see how digital KYB can streamline your onboarding, reduce risk, and enable scalable growth across Central Africa.